TL;DR ALICE is the new "middle" many people don't name: Employed, educated, and earning "okay" on paper - yet operating with thin buffers and high fixed commitments. Definition: Asset-Limited, Income-Constrained, Employed - households that aren't poor, but are one shock away from stress. Core problem: Income supports lifestyle, but without liquid buffers, it doesn't create resilience - it becomes something you must protect. Housing paradox: Homeownership builds wealth on paper, yet tightens monthly liquidity - creating "security on paper, vulnerability in practice". Renting trade-off: More mobility, but greater volatility - repeated rent resets can prevent savings from compounding into a buffer. Why it's expanding: Essential costs (Housing, Care, Daily living) have outpaced many wage trajectories, while income gains are uneven across the distribution. Resilience filter: Buffer (Cash months), Stress-test (One income dip), Upgrade rule (Cashflow improves), Exit clarity (Holding horizon). Bottom line: ALICE isn't a dead end - it's a warning light. If income alone no longer guarantees security, resilience must be built deliberately before the next commitment locks you in. Having a job in Singapore once implied stability.Work hard. Earn steadily. Pay your bills. Security would follow.For a growing group of Singaporeans, that equation no longer holds.They are employed, often educated, firmly part of the workforce - yet financially fragile. Not poor in the conventional sense, but constantly one unexpected expense away from stress.This group is known as ALICE. In this article, we will explore: What ALICE Really Means in Singapore Income, Assets, and the Myth of Security Housing: Stability and Strain at the Same Time Renting Isn't a Simple Alternative Why the ALICE Group is Expanding Rethinking the Middle Class - A Shift, Not a Dead End What ALICE Really Means in Singapore ALICE stands for Asset-Limited, Income-Constrained, Employed - a term that originated overseas, but describes a reality that feels increasingly familiar in Singapore: households that look "okay" by income, yet feel one life event away from financial strain.ALICE households are working and contributing members of the economy. Yet despite steady employment, they operate with little financial buffer.In practical terms, they typically:Earn incomes that appear adequate on paperHold limited liquid savings after CPF contributions and fixed expensesDepend heavily on monthly cashflowLack sufficient reserves to absorb unexpected shocksThey do not qualify as poor. They fall outside most assistance thresholds and appear self-sufficient.Their stability depends on continuity - as long as income flows uninterrupted and no major disruption occurs.They are not poor.They are not secure.Income, Assets, and the Myth of Security Singapore places strong emphasis on income growth, and the numbers reflect that. Recent SingStat data shows median monthly household income from work (including employer CPF contributions) has crossed the $12,000 mark - a clear sign of upward movement.Yet income growth alone does not guarantee security. In a property-led economy, housing values have risen faster than wages, and higher earnings often come with heavier commitments - mortgages, insurance, and family responsibilities that absorb much of the gain.Salaries increasingly service costs rather than build resilience.Income supports lifestyle. Assets provide resilience.Without buffers, income becomes something to protect - not something that protects you.Source: SingStatIncomes have risen across housing types. But the spread also reveals a structural divide: higher-income households are concentrated in private property, while lower-income households cluster in smaller HDB flats.Income and asset ownership are linked - yet rising earnings do not automatically translate into resilience as commitments and entry prices climb.Housing: Stability and Strain at the Same Time Consider a 32-year-old dual-income couple buying their first flat today: higher entry prices and a 25-30 year mortgage mean equity may grow, but monthly liquidity tightens from day one. After CPF deductions, loan repayments, and renovation outlay, their real bottleneck is spare cash - not headline income.Homeownership has long been a cornerstone of financial security in Singapore.But access to that security has shifted across generations.Earlier cohorts entered the market at lower price points and accumulated equity more quickly. Younger buyers today face higher entry prices, later starts, and longer mortgage tenures.For ALICE households, this makes housing both stabiliser and pressure point.Decades-long loans, fixed repayments, renovation costs, and ongoing maintenance leave little flexibility. Wealth may accumulate on paper, but liquidity remains tight.A household can own a valuable property - yet struggle to free up cash in a crisis.The paradox is clear:Asset ownership without flexibility.Security on paper, vulnerability in practice. Before committing to a major housing decision, consider this resilience filter:Buffer: Maintain several months of essential expenses in liquid cash (not CPF).Stress-test: Ensure instalments remain manageable if one income drops temporarily.Upgrade rule: Move only when cashflow improves and buffers remain intact.Exit clarity: Understand likely holding period and resale realities before locking in.Renting Isn't a Simple Alternative Renting avoids long-term debt and offers mobility. But it introduces a different risk profile.Without equity accumulation, renters remain exposed to rising rents and recurring lease renewals. Each reset brings uncertainty - about affordability, location, and continuity.Years of rent payments provide shelter, but they do not build a financial buffer.For ALICE households, renting often means trading fixed obligations for volatility. Flexibility comes at the cost of predictability.That said, renting can make sense at certain life stages - when rebuilding savings, navigating career mobility, or preserving optionality before a major commitment.Whether owning or renting, financial risk remains - it simply takes different forms.Why the ALICE Group is Expanding The growth of ALICE households is not primarily about poor financial discipline.It is structural. It reflects asset-price dynamics, demographic shifts, and rising fixed-cost obligations - not simply personal budgeting choices.Living costs in essential areas - housing, transport, food, care - have outpaced wage progression for many roles. Childcare, healthcare, and eldercare impose sustained pressure on household budgets.Source: SingStatRecent income data shows that gains are unevenly distributed. While the median has increased, higher percentiles have advanced more sharply in absolute terms. This divergence means that households around the middle move forward more slowly relative to the top - reinforcing why financial pressure can persist even in a rising-income environment.Rethinking the Middle Class - A Shift, Not a Dead End Traditionally, being "middle class" implied resilience - not wealth, but the ability to absorb setbacks without long-term damage.Today, that definition is under strain.When a fully employed household remains one shock away from stress, the line between coping and being secure becomes thin.ALICE is no longer marginal. It sits within the modern middle - visible everywhere, yet rarely named.But acknowledging fragility is not the same as declaring defeat.If income alone is insufficient, stability must be built deliberately - by converting income into buffers and long-term assets. That begins with clarity: understanding your numbers, stress-testing decisions, and aligning property moves with long-term wealth plans.For households seeking deeping clarity, our upcoming Property Wealth System Masterclass offers a structured framework on market cycles, affordability, loan planning, upgrade pathways, and risk management - helping you make more intentional property decisions.The environment is tougher than it once was - but it is not immovable. Singapore's homeownership frameworks, CPF structure, and long-term asset model still provide pathways for accumulation.The middle class is not disappearing.It is evolving.Not poor does not automatically mean secure - but neither does ALICE mean stuck.ALICE isn't a label to fear - it is a signal to build resilience deliberately, before the next decision locks you in.Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.

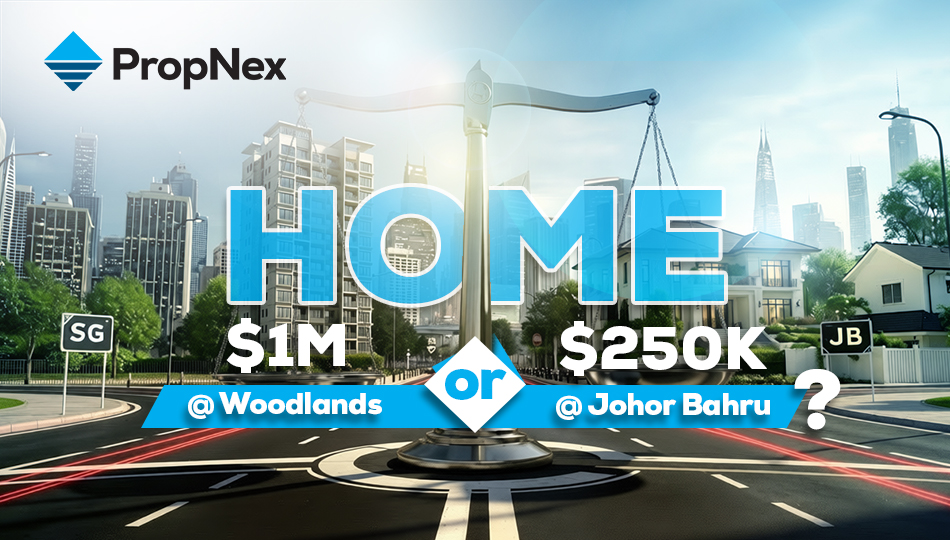

Read more