Cooling Measures Likely Weighed On HDB Resale Volume, But Prices Stayed Firm In September

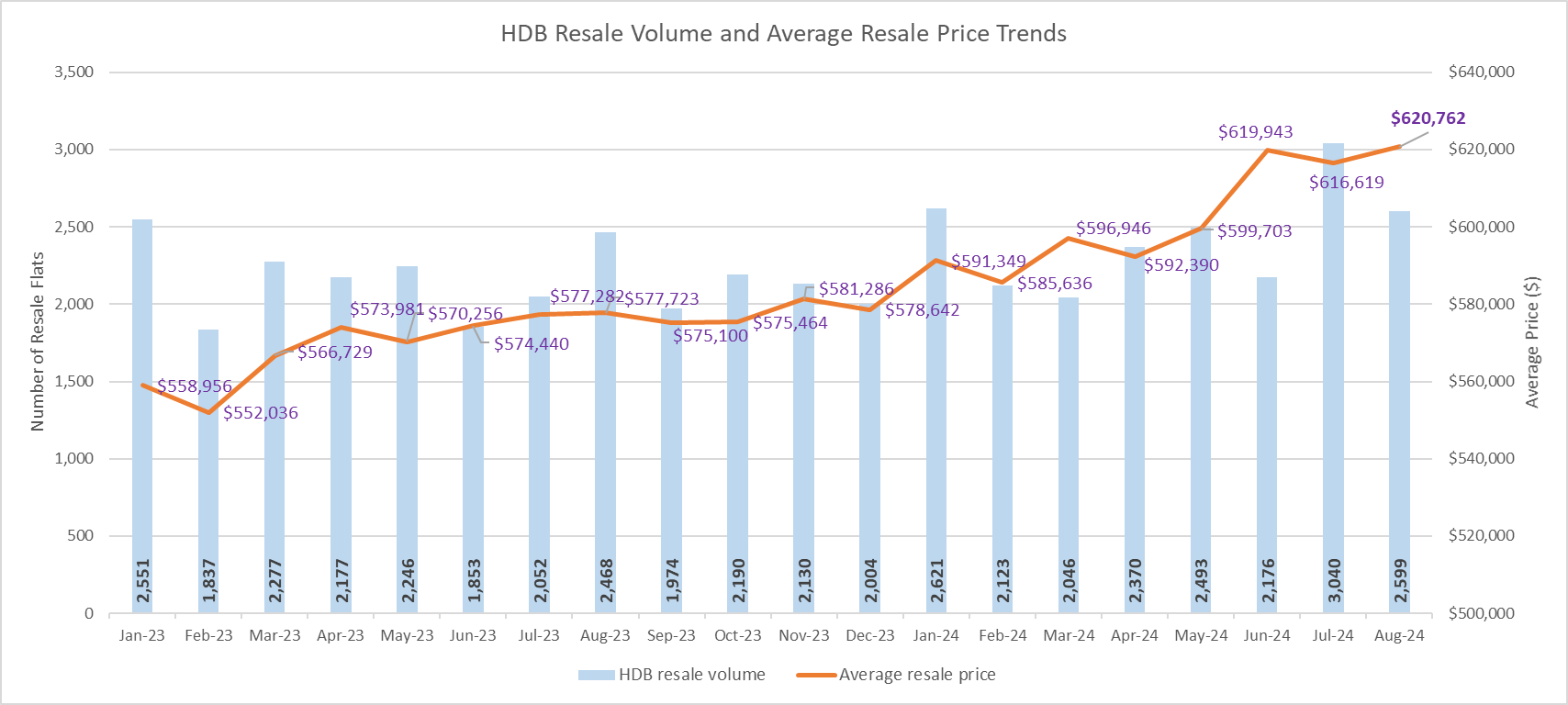

September 2024 witnessed a decline in HDB resale transactions, as the cooling measures introduced in end-August and the upcoming build-to-order (BTO) exercise in October could have put a drag on market activity. Transaction data showed that 2,216 resale flats were sold during the month, marking a 14.7% fall from August (see Chart 1). Non-mature estates accounted for about 61% of the month's transactions, led by Sengkang, Punggol, Jurong West, and Woodlands.

Owing to the reduction in loan-to-value (LTV) limit for HDB loans from 80% to 75% - with effect from 20 August 2024 - some prospective buyers may want to review their home financing plan, while others may opt to transact later, after assessing the measure's impact on the market in the coming months. That being said, the revised LTV limit is a targeted move which is not expected to impact most resale flat buyers. According to the National Development Minister, it could affect about 10% of those who finance their resale flat purchase with an HDB loan. As such, PropNex anticipates that resale flat demand could remain stable through the rest of the year, and in turn may lend support to resale prices.

Other factors that could have dampened sales include, a tighter supply of flats available for resale due to fewer flats reaching their 5-year minimum occupation period this year, as well as some flat owners - who either desire to upgrade or right-size to another property - potentially holding back from selling, as they have not been able to find a suitable replacement home. The upcoming October BTO exercise, where several attractive projects will be launched by the HDB could also have affected the resale segment, as some buyers may wish to apply for the new flats (which will be classified as Standard, Plus and Prime flats under a new fla classification framework).

Prices up despite the dip in sales

Despite the decline in transactions, the average HDB resale price climbed for the second consecutive month in September, rising by 1.2% month-on-month to nearly $628,549 - a record high. On a year-on-year basis, the average resale price was up by 9.3% from about $575,000 in September 2023 (see Chart 1).

Chart 1: HDB resale flat transaction volume and average resale price by month

The average price of most flat types, 3-room or bigger in mature and non-mature towns all witnessed growth in September from August, with the exception of executive flats in mature estates (see Table 1), where the average price fell by 4% MOM to about $961,000. Meanwhile, 4- and 5-room resale flats in mature estates saw stronger price increase of more than 5% MOM to about $756,000 and $893,000 in September, respectively. The prices were partly boosted by the million-dollar flats resold during the month (more on this later).

Table 1: Average transacted HDB resale flat prices in Mature and Non-mature towns

| Mature Towns | Non-Mature Towns | |||||

Flat Type | Aug-24 | Sep-24 | % change MOM | Aug-24 | Sep-24 | % change MOM |

3 ROOM | $451,290 | $459,597 | 1.8% | $436,882 | $440,915 | 0.9% |

4 ROOM | $715,581 | $755,956 | 5.6% | $582,531 | $589,159 | 1.1% |

5 ROOM | $847,452 | $892,513 | 5.3% | $684,383 | $684,289 | 0.0% |

EXECUTIVE | $1,001,288 | $961,474 | -4.0% | $837,939 | $849,938 | 1.4% |

Overall, 4-room flats led the average resale price growth at 3.2% MOM in September 2024 (see Table 2), helped by the flats being resold for at least $1 million in the month. Transaction data showed that there were 42 units of million-dollar flats that are 4-room flats, compared with 28 such units transacted in the previous month.

Meanwhile, executive flats saw the average resale price dip by 1.8% MOM in September, possibly affected by the cooling measures and also the higher base in August, following several months of price increase.

Table 2: Average transacted HDB resale flat prices by Flat Type in last six months

Flat Type | Apr-24 | May-24 | Jun-24 | Jul-24 | Aug-24 | Sep-24 | MOM % change |

3-ROOM | $430,961 | $432,522 | $442,068 | $443,658 | $445,568 | $452,272 | 1.5% |

4-ROOM | $605,043 | $613,124 | $634,811 | $638,906 | $628,910 | $649,127 | 3.2% |

5-ROOM | $710,615 | $718,076 | $743,971 | $728,213 | $733,806 | $742,261 | 1.2% |

EXECUTIVE | $871,600 | $857,144 | $876,113 | $882,217 | $897,892 | $881,356 | -1.8% |

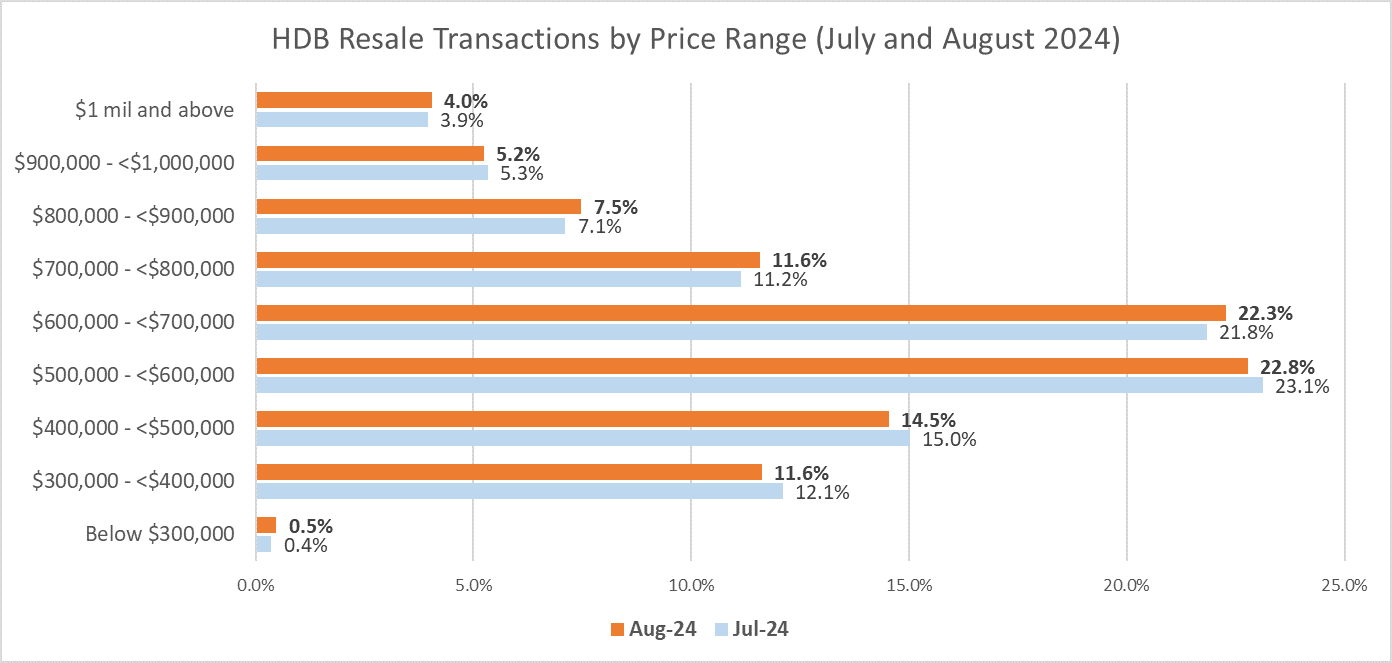

Chart 2: Proportion of HDB resale transactions by price range

In September, million-dollar resale flats made up about 4.8% of the month's transactions - up from the 4% in August (see Chart 2). Of note, the proportion of sales in the price bands ranging from $800,000 to under $1 million seemed to have stabilised, either flat or easing marginally in September from August. Meanwhile, the proportion of sales in the $700,000 to $800,000, and the $600,000 to $700,000 price bands ticked up slightly in September.

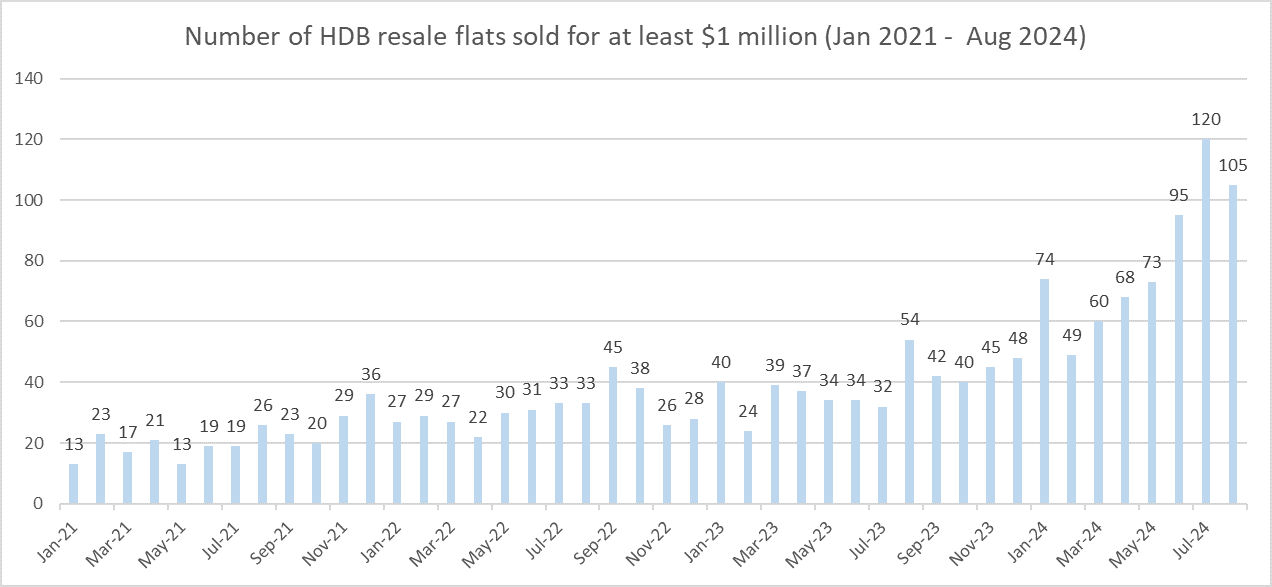

According to HDB's sales data, the number of million-dollar resale flats sold in September remained elevated at 106 units, marginally up from the 105 units sold in August (see Chart 3). This is the third consecutive month where the number of such flats sold has crossed the 100-unit mark. The million-dollar resale flats sold in September comprised 42 units of 4-room flats, 39 units of 5-room flats, and 25 units of executive flats.

Of the 106 units of million-dollar resale flats transacted, 11 flats are located in non-mature towns, namely in Bukit Panjang, Hougang, Jurong East, Woodlands, and Yishun. The remaining units are in mature estates, led by Kallang Whampoa with 20 such deals in September. Notably, Kallang Whampoa has garnered a persistently high number of million-dollar resale flat deals this year; the town has 121 such sales in the first nine months of 2024 - about 25% higher than Bukit Merah in second place, with 97 such transactions in 9M 2024.

Chart 3: Number of resale flats sold for at least $1 million

Table 3: Top 10 HDB resale flats sold in September 2024 by Transacted Price

Town | Type | Street | Storey range | Floor area SQM | Lease start date | Price | PSF ($) |

BUKIT MERAH | 5 ROOM | KIM TIAN RD | 40 TO 42 | 113 | 2013 | $1,580,000 | $1,299 |

CENTRAL AREA | 5 ROOM | CANTONMENT RD | 37 TO 39 | 107 | 2011 | $1,515,000 | $1,315 |

BUKIT MERAH | 5 ROOM | HENDERSON RD | 31 TO 33 | 113 | 2019 | $1,440,000 | $1,184 |

CENTRAL AREA | 5 ROOM | CANTONMENT RD | 34 TO 36 | 105 | 2011 | $1,435,000 | $1,270 |

CENTRAL AREA | 4 ROOM | CANTONMENT RD | 49 TO 51 | 94 | 2011 | $1,408,000 | $1,392 |

CENTRAL AREA | 4 ROOM | CANTONMENT RD | 37 TO 39 | 95 | 2011 | $1,400,000 | $1,369 |

BUKIT TIMAH | EXECUTIVE | TOH YI DR | 04 TO 06 | 146 | 1989 | $1,370,000 | $872 |

BUKIT MERAH | 5 ROOM | HENDERSON RD | 13 TO 15 | 113 | 2019 | $1,340,000 | $1,102 |

KALLANG/WHAMPOA | 5 ROOM | UPP BOON KENG RD | 10 TO 12 | 113 | 2017 | $1,330,000 | $1,093 |

BUKIT MERAH | 5 ROOM | KIM TIAN RD | 34 TO 36 | 113 | 2013 | $1,320,000 | $1,085 |

The top resale transaction in September was for a 5-room unit in Kim Tian Road which fetched $1.58 million (see Table 3). The flat has a floor area of 113 sq m (about 1,216 sq ft) and is located on a high floor ranging between the 40th and 42nd storey.

Taken together, there were 750 units of resale flats that have been sold for at least $1 million on the market in the first nine months of 2024 - already exceeding the record 469 such flats resold in the whole of 2023. PropNex anticipates that the number of million-dollar resale flats sold may potentially hit 1,000 units this year, going by recent the transaction trend.