Resale Landed Market Watch In December 2025

Resale Land Prices remain tepid with slower market activity in December

Landed home resale activity in December slowed down further due to the seasonal lull approaching the year end. Based on URA Realis caveat data, about 154 landed homes were transacted on the resale market in December 2025; the combined transaction value came up to $1.04 billion - compared to November (171 deals valued at $1.11 billion). Upon an analysis of each transaction and their respective gains, most landed deals were profitable.

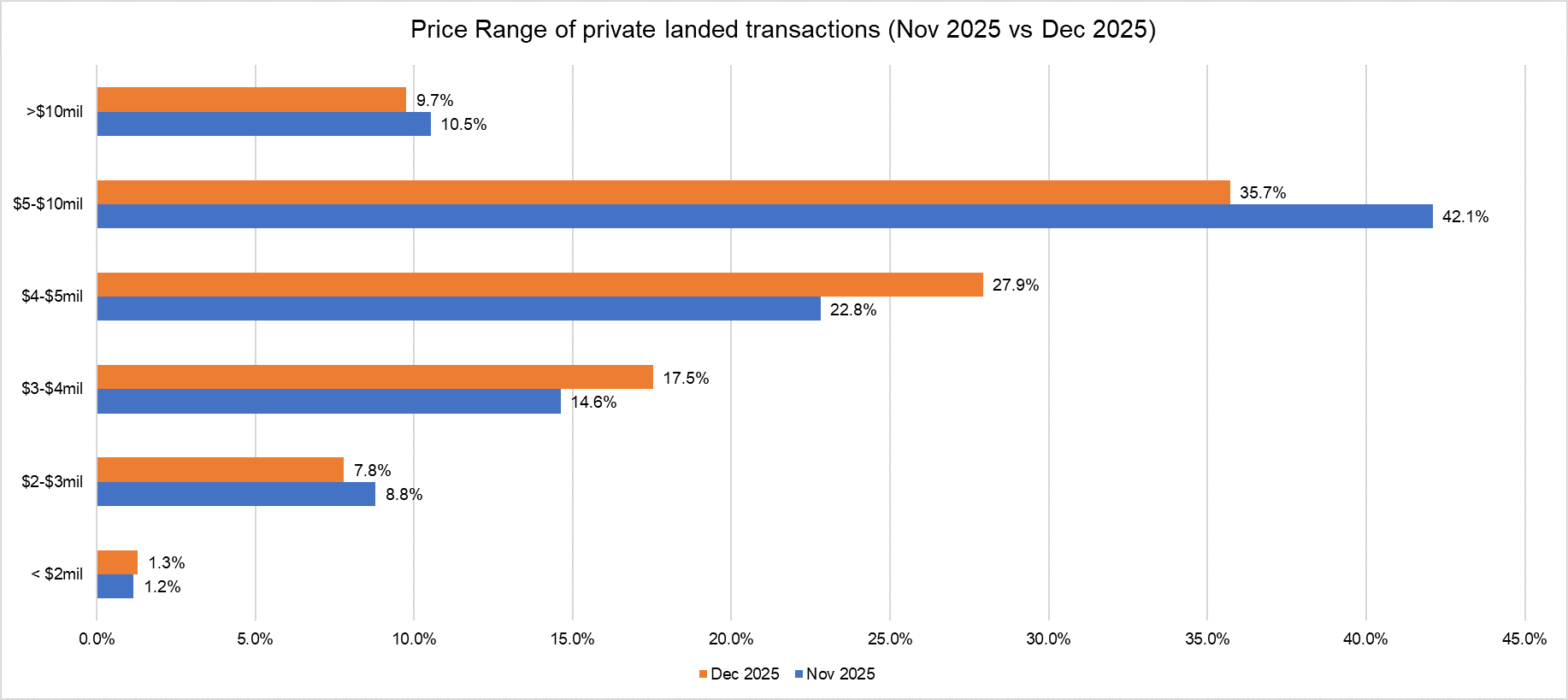

There was a lower proportion of higher priced landed homes being sold compared with the previous month due to the muted sales activity. Based on URA Realis caveat data, about 45.5% of resale landed homes sold in December were priced at $5 million and above, compared with about 52.6% in November. Meanwhile, 54.5% of the resale landed transactions were priced at below $5 million in December - declining from the 47.4% proportion in the previous month.

Chart 1: Price range of private resale landed transactions in November 2025 vs December 2025

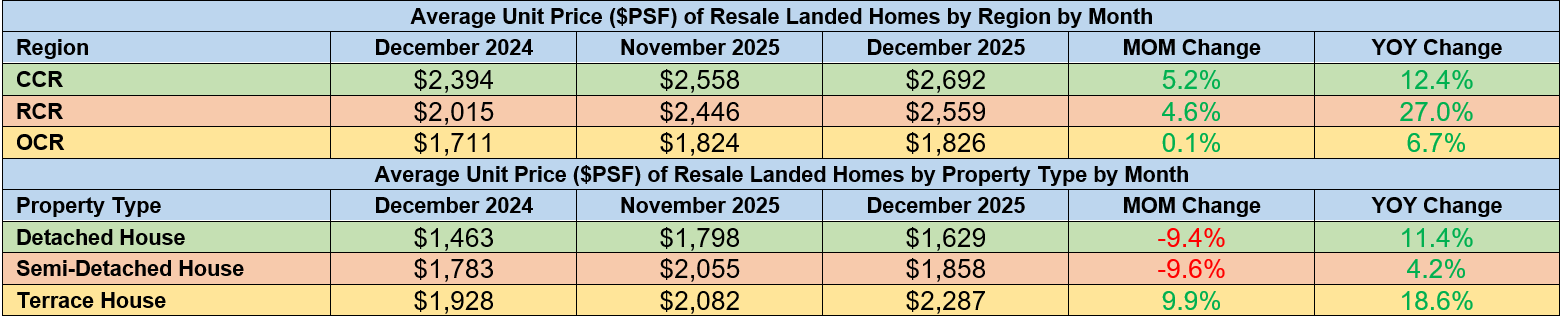

Growth of landed home resale prices in December 2025 was relatively homogenous across the regions. The overall landed homes resale prices continued to grow by 2.6% month-on-month (MOM) to $2,086 psf; while prices were up by 14.1% compared to a year before. The month-on-month increase in resale landed prices was led by the growth of prices in the Core Central Region (CCR) and Rest of Central Region (RCR) and which expanded by 5.2% and 4.6% MOM, respectively. Homes in the Outside Central Region (OCR), also edged up, strengthening by 0.1% MOM. By property type, detached and semi-detached homes saw average prices fell by 9.4% MOM and 9.6% MOM respectively in December. (see table 1 below).

Table 1: Average Unit Prices ($PSF) of Resale Landed Homes by month

Resale landed homes performance by property type in December 2025

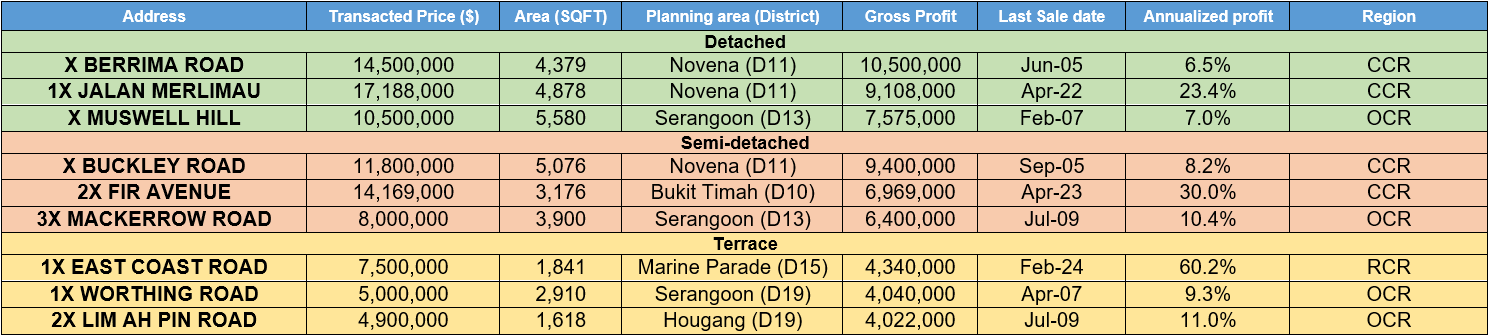

Table 2: Top 3 resale landed transactions by landed property type, in terms of estimated gains*

*Gains are derived from the resale transaction for each unit against the unit's last caveated transaction. The gains reflected is gross - it has not accounted for the applicable seller's stamp duties, interest payable, taxes and other relevant divestment costs.

**Annualised gain is the compounded annual rate of return which shows the rate of return over the time period between the point of resale and the property's last caveated transaction, expressed in annual percentage terms. The formula for determining this is simply: [(current resale price) / (purchase price)] time period in years-1

Top landed transaction with highest gains (Detached)

The top performing detached home transaction and overall landed transaction for the month was for a corner detached home along Berrima Road in District 11 (Novena) that was sold for $14.5 million, up by $10.5 million from the last caveat lodged in June 2005 - this reflects an annualised profit of 6.5% after a holding period of more than 20 years. The freehold property is situated near Botanic Gardens and has a land area of more than 4,300 sq ft which reflects a unit price of $3,311 psf on land area.

Top landed transaction with highest gains (Semi-Detached)

The best-performing semi-detached transaction was for the sale of a semi-detached property in Buckley Road in Novena (District 11). It was sold for $11.8 million in December, with its last caveat being lodged in September 2005. The sale price is up by over $9.4 million from the previous caveated price, representing an annualised gain of 8.2% per year over 20 years. The freehold property is situated within the Newton landed area and just within walking distance to Newton MRT station.

Top landed transaction with highest gains (Terrace House)

The best-performing terrace home transaction was for a terrace house along East Coast Road in Marine Parade (District 15). The freehold property was sold for $7.5 million, reflecting an estimated gain of $4.34 million, representing a whopping annualised gain of 60.2% per year from its last caveat lodged in February 2024, with a holding period of a little over a year.

If you are looking for high-end homes or good class bungalows in Singapore, contact PropNex's GCB and Prestige Landed department for buying and insights on the landed residential property market.

For more property research insights, join PropNex Friends today.

Disclaimer:

While every reasonable care is taken to ensure the accuracy of information printed or presented here, no responsibility can be accepted for any loss or inconvenience caused by any error or omission. The ideas, suggestions, general principles, examples and other information presented here are for reference and educational purposes only.

This information contained herein is not in any way intended to provide investment, regulatory or legal advice or recommendations to buy, sell or lease properties or any form of property investment. PropNex shall have no liability for any loss or expense whatsoever, relating to any decisions made by the audience.

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position.

No part of this content November be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.

All copyrights reserved.