District 9 Boutique Condos: Strategy or Lifestyle Lock-In?

After weeks of analysing the early-2026 launch rush (Part 1 and Part 2) and breaking down contrasting decisions in District 18 (EC vs Private Condo) and 26 (Landed vs Private Condo), District 9 requires an entirely different lens: Boutique condominiums.

Boutique condominiums occupy a very specific niche within Singapore's private housing market. They are not designed for mass participation, nor are they driven by volume, aggressive marketing, or rapid turnover. Instead, boutique projects operate in a space shaped by scarcity, intent, and permanence.

Buyers considering boutique condos are rarely comparing multiple launches side by side. More often, they are stepping back to assess whether this type of home aligns with how they intend to live, hold property, and manage change over the long term.

Unlike typical private condo launches where flexibility, exit option, and price bands dominate decision-making, boutique condos demand a more deliberate mindset. The choice is less about optimisation and more about commitment.

This article is therefore not about chasing launches. It is about understanding what boutique living truly represents - and whether it functions as a strategic housing decision or a lifestyle choice that naturally locks you in.

In early 2026, three boutique developments are expected to enter the market within a relatively short window:

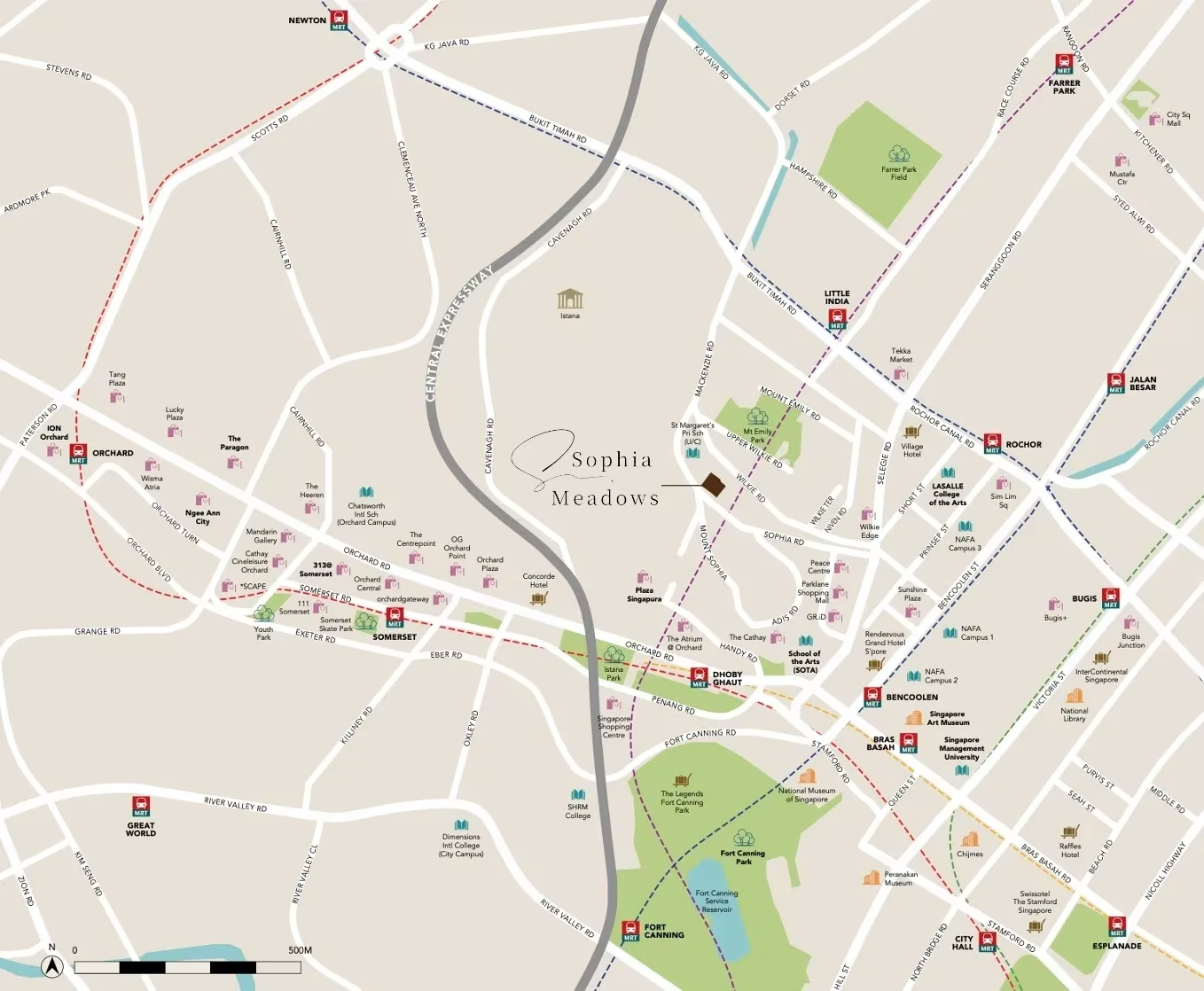

Sophia Meadows is a 104-year leasehold 41-unit boutique development slated for preview in February. The site was acquired by boutique developer Sin Thai Hin for $33.588 million, reflecting a land rate that underscores both the scarcity and long-term confidence in the Mount Sophia enclave. Located along Sophia Road within a conserved residential pocket near Dhoby Ghaut, the low-rise nature of the project reinforces its positioning as a quiet, low-density home in a highly central location. Its appeal lies in pairing true city-fringe accessibility with a level of privacy that larger developments in more commercialised areas often struggle to provide.

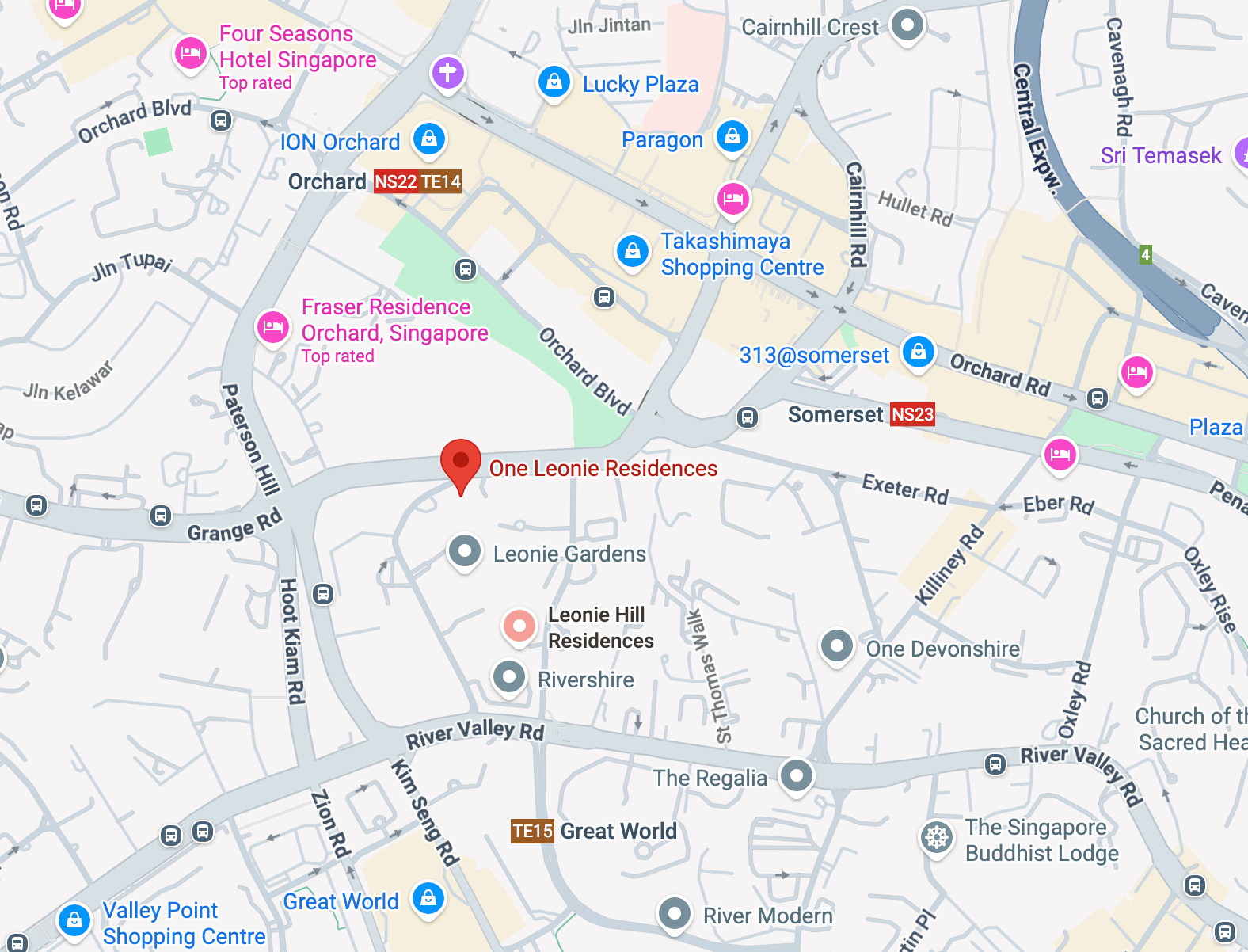

10-year data of projects within 100m radius of Sophia Meadows

Looking at transaction data from boutique developments within a 100m radius over the past decade, a few patterns emerge. Most nearby projects are freehold, low-rise, and small in scale, with unit counts typically below 80 units. Transactions are infrequent, reflecting how tightly held this micro-enclave is, while price levels have generally remained resilient where sales have occurred. This provides a useful reference point for understanding how projects in this pocket are typically priced and sized.

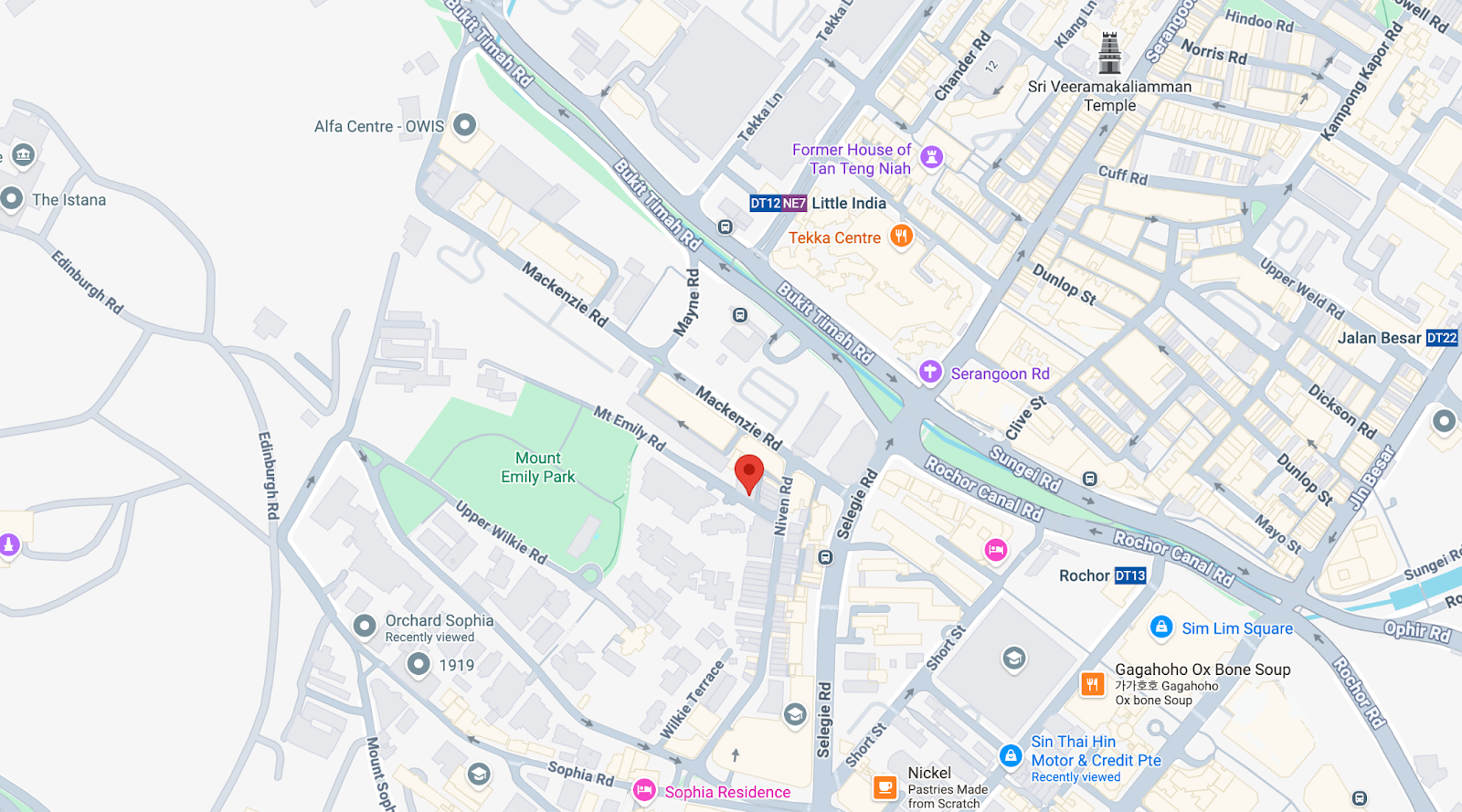

Duet@Emily is an even more intimate freehold project, comprising just 20 units. Based on the project description, it is a conservation-led development involving proposed additions and alterations to an existing three-storey conserved building, with basement and attic, together with a new two-storey rear extension that also incorporates basement spaces for residential use. The site was assembled through the collective sale of 2, 4, and 6 Mount Emily Road for $18 million, highlighting both the fragmented land ownership and the effort required to create a new development in this tightly held enclave. Situated around the Emily Hill area, projects of this nature typically appeal to buyers who value heritage character, discretion, and a living experience that feels closer to a private residence than a conventional condominium.

10-year data of projects within 100m radius of Duet@Emily

Looking at boutique projects within a 100m radius over the past decade, resale activity has been limited, consistent with the tightly held nature of the Emily Hill area. This suggests pricing expectations are shaped more by scarcity and character than by transaction velocity, with unit mixes typically calibrated to a niche, owner-occupier-led demand profile.

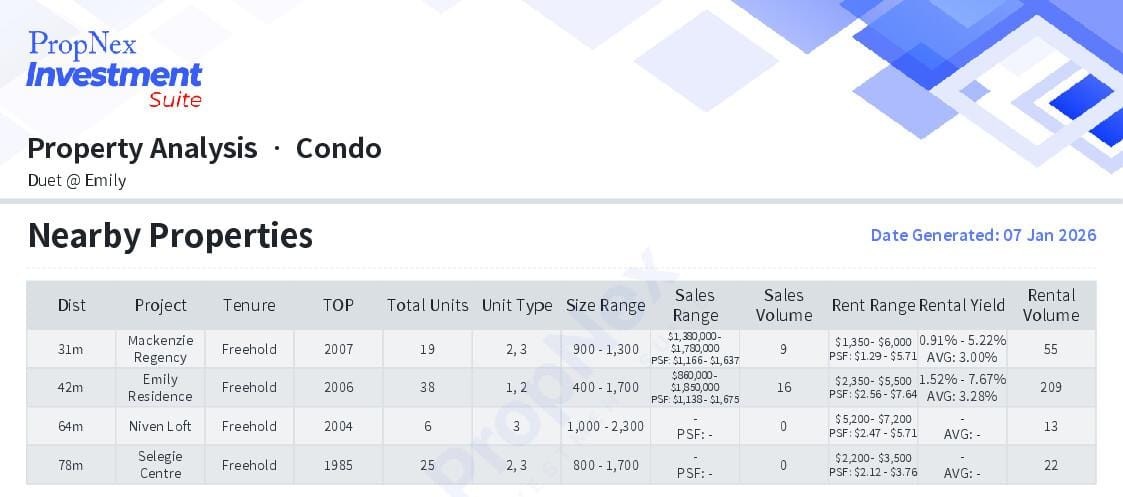

One Leonie Residences, with 70 units, is a freehold boutique development located within the established Leonie Hill enclave. Positioned along Leonie Hill Road, it sits within a long-standing prime residential neighbourhood known for its low-density character and close proximity to Orchard Road and River Valley. Rather than introducing a new concept, its appeal lies in offering buyers rare entry into a tightly held freehold enclave, where opportunities to secure new homes have historically been limited.

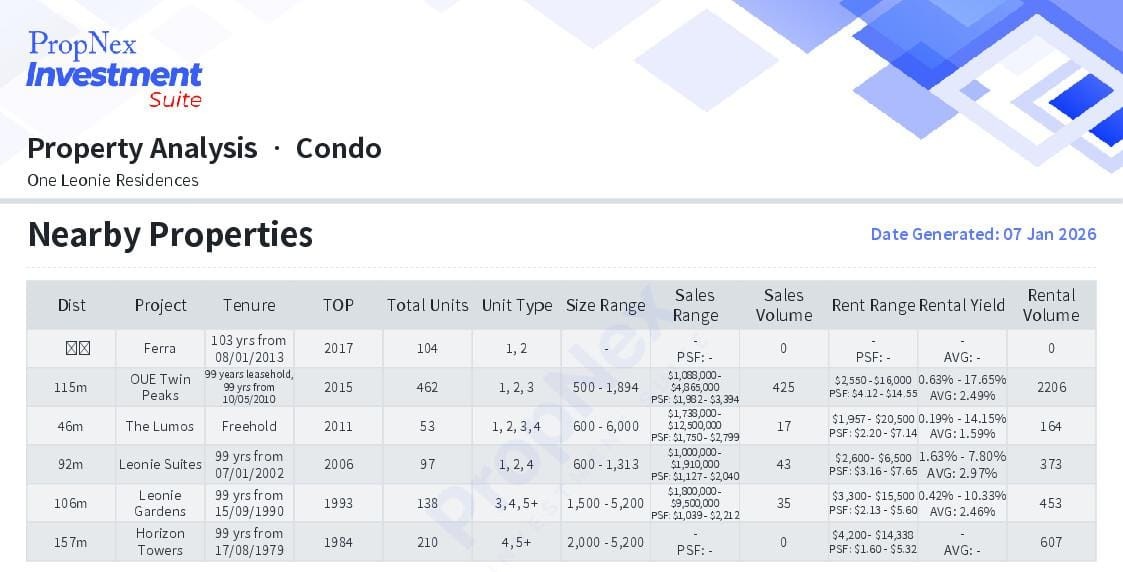

10-year data of projects within 200m radius of One Leonie Residences

Looking at projects within a 200m radius over the past decade, surrounding developments are generally larger, established condominiums with a wider mix of unit sizes. This reflects Leonie Hill's role as a recognised prime residential corridor, where pricing benchmarks are shaped by established comparables rather than niche micro-market behaviour.

Individually, these projects are small and unlikely to dominate headlines. Collectively, however, they represent a rare cluster of ultra-low-density private homes in one of Singapore's most established prime districts.

What stands out immediately is not the timing, but the scale. Unit counts below 50 - and in one case, below 20 - are not accidental. They signal a deliberate positioning towards buyers who value privacy, discretion, and a quieter living environment over shared facilities or large communal spaces.

At this stage, it is important to avoid fixating on speculative details such as pricing, layouts, or yields. What matters more is recognising that these projects are designed for a very specific buyer profile - and that design choice has long-term implications.

The term "boutique condo" is often used loosely, but in practice, it describes a very specific development model with clear structural implications.

At its core, boutique living is defined by low density. Fewer units translate into fewer neighbours, reduced foot traffic, and a generally quieter environment. This naturally appeals to owner-occupiers who value privacy and a more residential feel over the buzz of larger developments.

Boutique projects also tend to see lower transaction frequency due to their smaller scale and narrower buyer pool. This affects how resale behaves, but rather than repeating the mechanics here, it is more useful to view this as a structural characteristic that carries through the rest of the discussion.

Finally, boutique condos usually place less emphasis on extensive shared facilities. Instead of scale-driven amenities, value is concentrated in location, neighbourhood maturity, and everyday liveability. A practical outcome of this structure is that maintenance fees are often higher on a per-unit basis, as operating costs are spread across a much smaller number of owners.

If you are weighing boutique developments against larger condominiums, we explore these structural differences in greater detail in our earlier piece, Boutique vs Mega Developments: Which To Go For?.

Before exploring why some buyers are still drawn to boutique condos, it is important to first understand the compromises that come with this choice.

Across various Reddit discussions, boutique condo projects are often seen as lifestyle-driven rather than investment-led choices. Commenters frequently cite higher maintenance costs, fewer facilities, weaker resale liquidity, and greater vulnerability to price drops from fire sales or ageing issues. While some value the privacy, freehold status, and quieter living environment, many note that price appreciation tends to lag larger developments unless the entry price, location, or en-bloc potential is exceptional.

These trade-offs are not theoretical. Similar concerns are frequently raised by homeowners discussing small developments online.

Boutique condos typically command higher absolute prices due to their prime locations and low-density land use. In many cases, unit sizes may also be more compact when compared to suburban developments at similar price points, as a greater share of value is concentrated in location rather than internal space.

Liquidity is another practical consideration. With fewer comparable transactions and a narrower buyer pool, resale activity can be slower, particularly during more subdued market conditions.

There is also a longer-timer adaptability consideration. While boutique units may offer flexibility in internal layout, the development itself may be less forgiving if household needs change materially over time - such as expanding family requirements or significant shifts in work location.

These factors do not make boutique condos inferior choices, but they do require buyers to proceed with clarity. Understanding these trade-offs helps explain why those who eventually choose boutique living tend to do so deliberately, rather than by default.

Even after weighing these trade-offs, boutique condos continue to attract a specific group of buyers - not by coincidence, but by intent.

One key reason is layout and design flexibility. Many boutique developments are built on land acquired through collective sales rather than GLS sites, which means they are not subject to the Building and Construction Authority's requirement for a minimum 65% adoption of Prefabricated Prefinished Volumetric Construction (PPVC). Without this constraint, boutique projects are often constructed using more traditional methods, allowing greater freedom to merge rooms, reconfigure layouts, or adopt open-concept designs.

Practically, this means boutique owners often enjoy layouts that can evolve with how they live - not just how developers package units at launch. Without this constraint, boutique projects are often constructed using more traditional methods, allowing greater freedom to merge rooms, reconfigure layouts, or adopt open-concept designs. This flexibility strongly appeals to owner-occupiers buying for personal stay.

Another important consideration is freehold value concentration. Since the government no longer releases freehold land through the GLS programme, new freehold launches have become increasingly rare. Over the past decade, the majority of new freehold condominiums introduced to the market have been boutique developments, largely because smaller en-bloc sites are more accessible and manageable for developers. This has resulted in boutique projects forming a significant share of Singapore's new freehold supply.

For buyers, freehold tenure offers something fundamentally different from leasehold ownership. Without the issue of lease decay, freehold properties provide long-term holding security and are often viewed as assets that can be preserved - and potentially passed on - across generations. In land-scarce Singapore, this permanence carries meaningful value, particularly for buyers with a longer time horizon.

Architectural character also plays a role. Boutique developments, especially those in prime or conserved areas, are less constrained by mass-market expectations. This allows for more distinctive design approaches and living environments that feel less standardised.

Centrality further strengthens the appeal. Boutique projects are frequently located in mature, built-out neighbourhoods where new supply is limited. For buyers who value proximity to the city but want to avoid the density of large-scale developments, this combination remains compelling.

Taken together, these factors explain why buyers choose boutique condos not for short-term optimisation, but as intentional, long-horizon holdings - often valued as legacy assets rather than transactional homes.

Stepping back, it is clear that boutique condos are not designed to meet every buyer's priorities - and they are not meant to.

Are you comfortable with the idea that resale may take time, especially in very small developments where the buyer pool is narrower and transactions occur less frequently? If liquidity, faster exit options, or broad mass-market appeal are priorities, would a larger development align better with what you are looking for?

Do your lifestyle needs favour accessibility, extensive facilities, and a livelier environment - particularly if you have young children - or would a quieter, more restrained living setting suit your household better at this stage of life?

If these trade-offs are not deal breakers, are you deliberately choosing privacy, discretion, and a calmer residential environment, knowing that boutique living often works best for buyers who are comfortable committing for the longer term?

Ultimately, the decision hinges on intent. Boutique risk is rarely about price collapse - it is about misalignment.

Rather than asking whether boutique condos are objectively better or worse, buyers should consider whether such a home still makes sense if circumstances remain broadly unchanged over time. When the answer is yes, the choice tends to feel less like a compromise and more like a deliberate alignment with how one wants to live and hold property.

District 9 boutique condos sit outside the typical launch-rush narrative. They reward patience, conviction, and alignment - not speed or speculation.

The real decision is not between Sophia Meadows, Duet@Emily, or One Leonie Residences. It is between how you want to live and how long you are prepared to commit.

For buyers who need flexibility, boutique condos will always feel restrictive. For buyers who value certainty in how they live, they offer exactly the opposite.

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.