The Final Piece Of Early-2026's Launch Puzzle: Thomson View

Over the past few weeks, we have examined the early-2026 new launch landscape (Part 1 and Part 2) from multiple angles - timing pressure, trade-offs between different housing formats, and the balance between lifestyle alignment and long-term flexibility. Each piece examined a different decision point buyers are likely to face.

Thomson View sits at the end of this conversation deliberately - not to answer what to buy next, but to clarify what scale of living and liquidity buyers are ultimately choosing to commit to.

It is not a niche launch, nor does it invite a simple comparison such as EC versus private condo, or private versus strata-landed living. Instead, it represents a scale-and-density decision - one that requires buyers to confront what committing to a large, redeveloped mega development truly entails.

This article is therefore less about judging whether Thomson View is attractive, and more about clarifying the realities that come with choosing a project of this nature.

Mega developments are commonly understood as projects with around 1,000 units or more, though the term is sometimes applied to developments that come close to that threshold. More importantly, they are defined by scale across multiple dimensions: land size, resident population, facilities provision, pricing structure, and sales timelines.

Because of this scale, mega developments typically offer:

A broader range of facilities enabled by larger land parcels, such as multiple pools, expansive landscaped areas, and a wider mix of communal amenities.

More efficient sharing of maintenance costs, as expenses are distributed across a much larger number of households.

Pricing that is often positioned more competitively at launch, reflecting the need to appeal to a broad buyer base.

Higher long-term transaction volumes, which can help support resale pricing through consistent market activity rather than isolated trades.

These advantages, however, come with clear trade-offs. Larger resident populations translate into higher density, greater sharing of facilities, and more comparable units competing with one another at resale. Mega developments therefore amplify both convenience and compromise. They tend to reward expectation alignment rather than optimism - favouring buyers with the discipline to plan for density, comparables, and longer holding horizons.

From Low-Density Estate to Mega Development

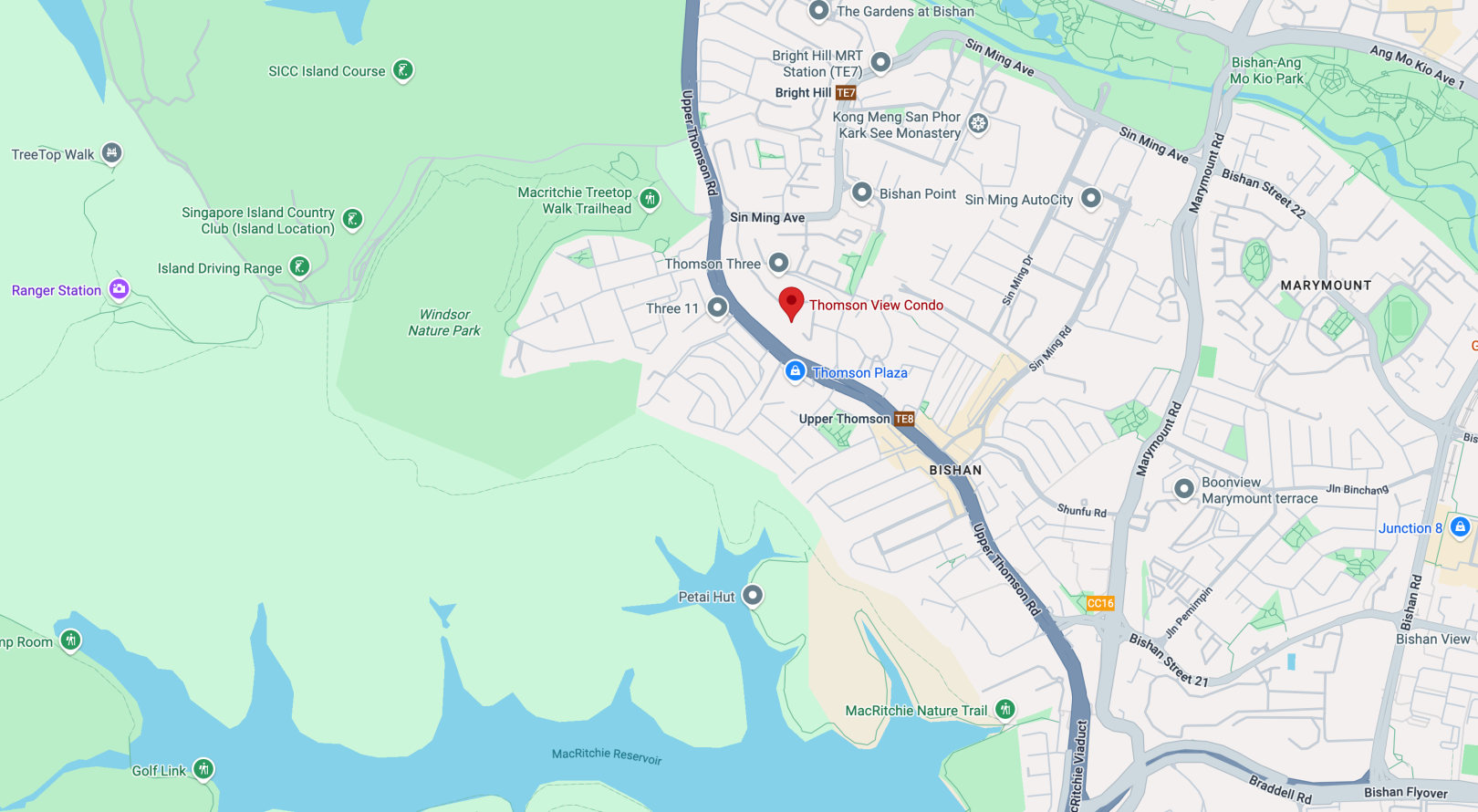

Source: Google Maps

Thomson View is an en bloc redevelopment of an existing private condominium, and notably, it retains its original name. While this creates a sense of continuity, the underlying fundamentals of the project have changed materially.

The original Thomson View was a 99-year leasehold development along Bright Hill Drive, with its land lease commencing in 1975. By the time the collective sale was completed, the estate had roughly 49 years remaining on its lease. The former development comprised about 200 apartments, 54 townhouses and a shop unit, all set within a five-hectare site.

Following several unsuccessful collective sale attempts, the estate was eventually sold at a price of $810 million after sufficient owner support was secured and court approval obtained. As part of the redevelopment, the land lease will be refreshed to a full 99 years, effectively resetting the tenure clock for the new project - though this reset does not automatically translate into a market reset.

The new Thomson View will introduce approximately 1,240 residential units on the same land parcel. This represents a clear transition from a low-density, legacy estate to a full-scale mega development.

What remains familiar is the location and the name. What changes is the lived experience. Density, facilities usage, internal competition, and long-term resale dynamics will all differ meaningfully from what the original estate once offered.

Legacy Names, Reset Markets

Thomson View is not the first redevelopment to retain the identity of the estate that came before it.

A recent example is Chuan Park, a mid-sized private condominium from the mid-1980s that was redeveloped after a contested en bloc process. The original 446-unit estate was replaced with a significantly larger, 916-unit residential project, fundamentally altering the site's density, buyer profile, and market positioning.

The key takeaway from such precedents is not guaranteed outcomes, but structural change. Retained project names often act as emotional anchors for buyers, but they are not pricing anchors once scale and density shift. When redevelopment and scale increase together, the market no longer prices the project as a continuation of the former estate. It is assessed as an entirely new offering, regardless of the name retained.

What This Scale Shift Means for Buyers

At a practical level, rebuilding at this scale introduces several realities buyers must be comfortable with:

Higher resident density and heavier shared use of facilities

Comprehensive amenities that are attractive, but more intensively utilised

Standardised layouts that prioritise efficiency over uniqueness

Greater internal competition when units eventually enter the resale market

As a result, developments like Thomson View tend to suit buyers with longer-term own-stay intentions who are comfortable trading individuality for scale, convenience, and facilities depth.

Despite its redevelopment history, Thomson View will behave like other large-scale new launches in one important respect: time.

With a wide range of unit types, stacks and pricing tiers, sales typically unfold in phases. Early interest should not be mistaken for scarcity, and price discovery often takes place gradually rather than all at once. Compared to boutique developments, buyer urgency tends to be lower and decision timelines longer.

Market data on large-scale projects suggests that mega developments are not necessarily about outsized gains, but about consistency. Higher transaction volumes tend to smooth out pricing movements over time, resulting in steadier resale behaviour rather than sharp spikes. In this context, scale supports liquidity and price stability more than rapid appreciation - favouring planners seeking consistency over speculators chasing momentum.

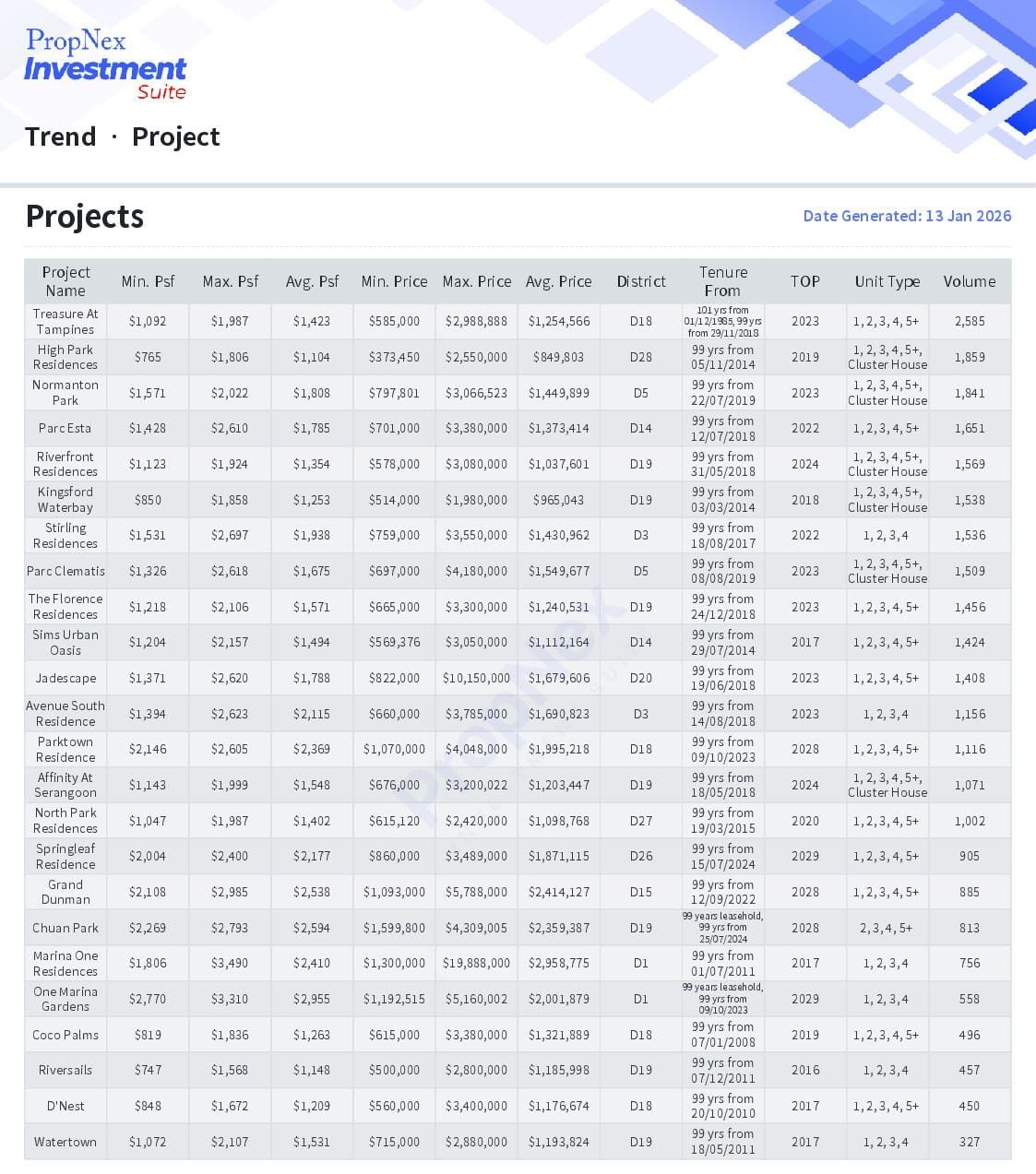

To ground this observation, the accompanying data set focuses on large private condo projects with a minimum unit count of roughly 900 units, all of which are 99-year leasehold developments that obtained TOP from 2015 onwards. The transactions reflected span approximately the past 10 years.

What emerges from this group is not uniform price growth, but consistency. These projects tend to record regular resale activity year after year, with pricing supported by volume rather than scarcity. This reinforces the idea that mega developments function less as momentum-driven assets and more as stable, liquid housing stock within the private market.

This is a normal feature of mega developments. A familiar site does not translate into familiar market behaviour once scale increases significantly, and an en bloc backstory does not change the underlying dynamics of supply, absorption, and competition.

Thomson View is expected to enter the market following a wave of early-2026 launches, at a point where many buyers are already experiencing comparison fatigue. In this sense, it serves as a natural closing chapter to the first-half launch cycle.

Rather than asking whether this is a good launch, buyers may benefit from reframing the question:

Does a large, redeveloped mega development align with how I plan to live, hold property, and adapt over time?

For buyers who value scale, facilities, and long-term own-stay practicality, Thomson View may fit naturally into that equation. For those seeking uniqueness, faster exit optionality, or lower-density living, it may not.

As the first half of 2026's launch puzzle comes together, the market now shifts from choosing between options to living with the consequences of those choices. Clarity, rather than urgency, will matter most going forward. Thomson View is not a compromise product - it is a commitment product.

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.