Stamp Duty Explained (2025)

Anyone looking into the real estate market will often come across the term Stamp Duty , but what does it really mean? Stamp duty is a tax on documents relating to immovable properties. In Singapore, stamp duty is classified into seven categories. However, we will only delve into the three duties that regulate the sale and purchase of properties: Buyer's Stamp Duty (BSD), Additional Buyer's Stamp Duty (ABSD) and Seller's Stamp Duty (SSD).

These duties affect the overall cost of both buying and selling properties, making them a vital part of property transactions in Singapore. They regulate the real estate market, manage demands, formalise agreements and generate revenue for the government.

Understanding how these duties work can help buyers and sellers to plan their finances, desired returns and exit strategy accordingly. This includes exploring options to reduce costs and taking advantage of available incentives. On top of that, investors can use this knowledge to assess acquisition costs and calculate potential returns, allowing them to maximise profitability and mitigate risks.

Failing to comply with stamp duty regulations may result in legal consequences and penalties. So let's jump right into the details of these duties and what they mean to both buyers and sellers.

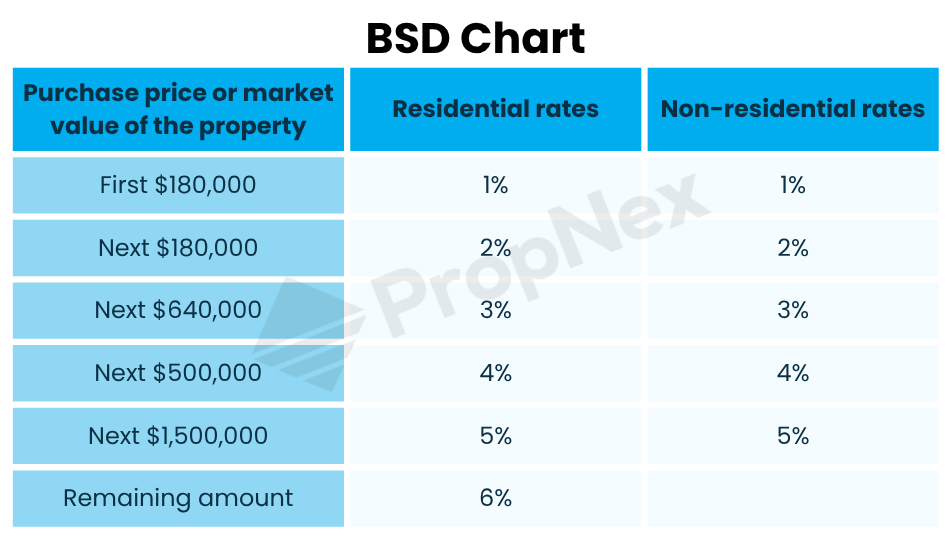

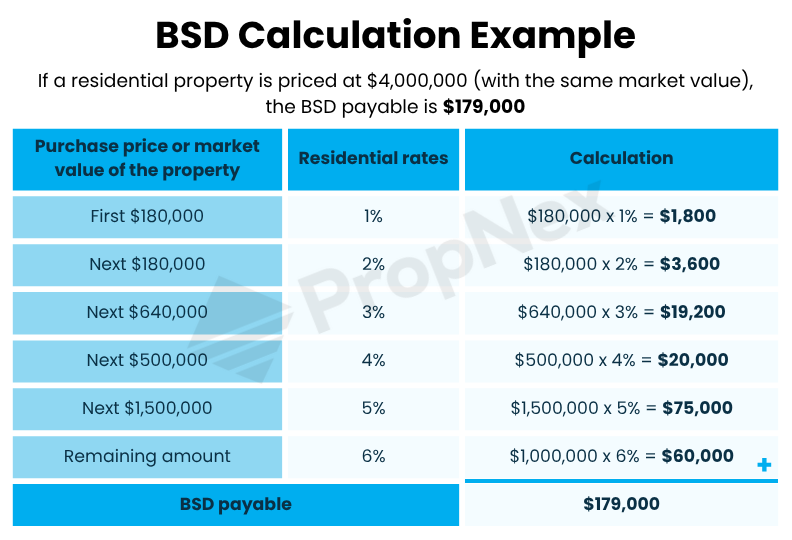

BSD is a tax imposed on anyone who buys or acquires (by way of gift) properties in Singapore. It is computed based on either the purchase price or the market value, whichever is higher. The latest BSD rates (for acquisition of property on or after 15 February 2023) are as follows.

On top of the BSD, buyers might also be required to pay an ABSD. However, this is only imposed on the purchase of additional residential properties. Just like the BSD, ABSD is computed based on either the purchase price or the market value, whichever is higher. The applicable ABSD rate varies depending on the buyer's profile at the time of purchase. Those who have Singapore Citizenship (SC) status or Singapore Permanent Resident (SPR) status may enjoy a lower ABSD rate. It can also vary depending on the amount of properties owned by the buyer. For joint purchases, the highest applicable rate is applied to the entire value of the property. The latest ABSD rates are as follows.

Furthermore, residential properties transferred to a living trust will be subject to an ABSD rate of 65%.

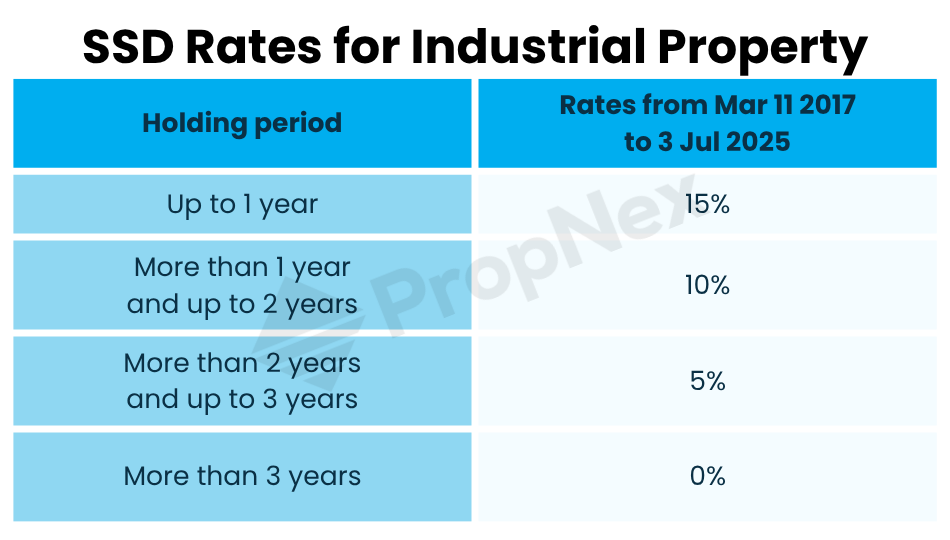

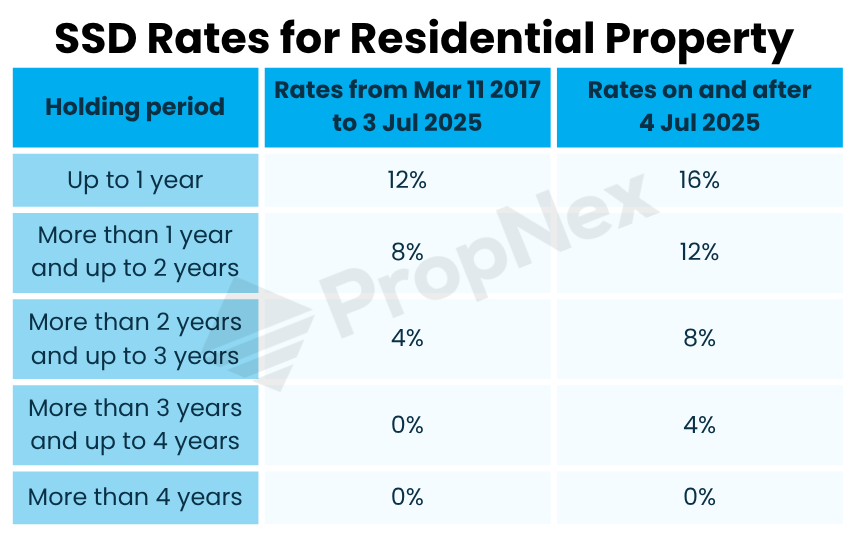

Like buyers, sellers are also required to pay stamp duties computed based on the actual price or the market value, whichever is higher. However, the rates may differ depending on the type of property and holding period, which is counted from the date of purchase or acquisition. The latest SSD rates are as follows.

In certain cases, you might be eligible for reductions or exemptions in the duty payable. However, these are typically subject to strict eligibility criteria. Check below if you qualify for a remission.

| Remission rules and conditions | Type of property | BSD | ABSD | SSD |

Remission of ABSD for a Married Couple

Conditions: - A married couple (must include an SC) jointly purchasing their first residential property is eligible for full ABSD remission - A married couple (must include an SC) jointly purchasing their second residential property is eligible for ABSD refund. However, they must sell their first residential property within 6 months after a. the date of purchase of the second property (for completed property), or b. the issue date of the Temporary Occupation Permit (TOP) / Certificate of Statutory Completion (CSC), whichever is earlier (for uncompleted property) | HDB flat / Private Residential Property | No | Yes | No |

Acquisition of HDB Flats and new Executive Condominium (EC) Units

Notes:

Conditions: - ABSD is fully remitted if at least one of the acquirer/purchaser is an SC - ABSD is fully remitted for an SPR getting a replacement HDB flat because their original flat was acquired by HDB under the Selective En-Bloc Redevelopment Scheme (SERS) - ABSD is fully remitted for acquisition of recess areas directly from HDB under the SERS | HDB flat and new EC unit | No | Yes | No |

Aborted Sale and Purchase Agreements

Conditions: - The agreement is revoked on or after 18 Feb 2005 - The reason for aborting the agreement is not to facilitate the vendor in disposing the property to another person - The application for remission is made within 6 months since the agreement is revoked | All types of property | Yes | Yes | Yes |

Matrimonial Proceedings

Conditions: - The property transfer is due to a divorce proceeding and in compliance with court's order regarding division of matrimonial assets - The property is transferred from one party of the matrimonial proceeding to the other, or to any child(ren) of the parties | All types of property | Yes | Yes | Yes |

Foreigners Eligible for ABSD Remission under Free Trade Agreements

Condition: Nationals and Permanent Residents of Iceland, Liechtenstein, Norway or Switzerland as well as Nationals of the United States of America will be given the same stamp duty treatment as SCs

| HDB flat / Private Residential Property | No | Yes | No |

ABSD Concession for Single Singapore Citizen (SC) Seniors

Conditions: - ABSD on the second residential property is paid - The first residential property is owned by a single SC aged 55 and above or jointly owned by single SCs aged 55 and above who are immediate family members - The owners of the first residential property must also be the owners of the second residential property. Any additional owners joining in the purchase of the second residential property must also be single SCs aged 55 and above who are immediate family members - The buyer(s) do not own more than one residential property each when purchasing the second one, and have not bought or acquired any other residential property since then - The buyer(s) must sell their first residential property(s) within 6 months after a. the date of purchase of the second property (for completed property), or b. the issue date of the Temporary Occupation Permit (TOP) / Certificate of Statutory Completion (CSC), whichever is earlier (for uncompleted property) - During the sale of the first residential property(s), there should be no change of ownership in the second one - The value of the second residential property is less than the value of each of the first residential property(s) sold - The application for refund is made within six months after the date of sale of the first residential property(s) | Residential Property | No | Yes | No |

Remission of ABSD (Trust)

Note: The amount refunded will be based on the difference between the ABSD (Trust) paid and the ABSD payable (highest possible)

Conditions: - The residential property is held on trust for identifiable individual beneficiaries only - ABSD (Trust) of 65% has been paid - The application for a refund is made within six months after the date of execution. | Residential Property | No | Yes | No |

Transfer of HDB Flats Within Family

Note: Not applicable to EC Units

Conditions: - The incoming lessee is an SC or SPR and also an immediate family of any remaining lessee - The transfer of ownership does not involve any payment or financial transaction except for reimbursing the outgoing lessee's Central Provident Fund (CPF) account - One of the existing lessees has to remain a lessee after the transfer, and they must be someone who: a. acquired the flat and paid stamp duty on the acquisition, or b. acquired the flat through mutual exchange and paid stamp duty on the exchange, or c. acquired the flat through assent, distribution or a will, or d. acquired the flat upon the death of a fellow joint tenant | HDB flat | Yes | No | Yes |

Purchase of Remnant Land from the State

Conditions: - The remnant land is a state land purchased directly from SLA that is incapable of independent development - The remnant land is used by the (joint) purchaser(s) for residential purpose - The (joint) purchaser(s) acquired the remnant land as beneficial owner(s) - The (joint) purchaser(s) cannot sell or dispose of any part of the remnant land or primary plot (the land that adjoins the remnant land) within 4 years from the date of purchase. | State Land | No | Yes | No |

Conveyance Directions

Conditions whereby the buyer(s) directs the vendor to transfer the property to a company that is or will be incorporated by the buyer: - At the point of contract, it is clear that the buyer intends to transfer the property to a company they have created or will create - The conveyance direction is made within two months after the contract date, with full duty paid and no exchange of consideration between the buyer and the company - The buyer holds beneficial interest in over 50% of the company's share capital and voting rights throughout the following period: a. from the date of purchase to the date of the last Temporary Occupation Permit (TOP) issuance, or b. From the date of purchase to the date of the transfer (given the TOP had already been issued at the time of purchase) - The amount of ABSD remitted cannot exceed the amount paid on the contract. For instance, if the ABSD rate paid on the contract is X% where X% is less than 65%, then the ABSD remitted is x%. The ABSD payable will be the difference of 65% and X% - This type of remission does not apply if the company is or will be incorporated for property development purposes

Conditions whereby the buyer(s) directs the vendor to transfer the property (or any share) to another family member: - The conveyance direction must be issued within two months of the contract date - Full duty must be paid on the contract - No consideration has passed between the buyer(s) and the family member - At least one of the original buyer(s) must remain as an owner - The amount of ABSD remitted cannot exceed the amount paid on the contract. The remitted ABSD is calculated as follows: (X + Y) - Z, where: X = ABSD paid on the contract Y = ABSD payable on the conveyance direction without remission Z = ABSD payable on the contract if all purchasers named in the conveyance direction were buyers under the contract.

If the result is zero or negative, no ABSD remission occurs and the ABSD payable on the conveyance direction is "Y."

If the result is positive, then that amount is remitted | All types of property | Yes | Yes | Yes |

Donations to an Institution of a Public Character (IPC)

Conditions: - The donation recipient is an IPC under the Charities Act - The donor had paid ad valorem duty when they acquired the property or shares unless stamp duty has been remitted | All types of property | Yes | Yes | Yes |

Given its significant impact, homebuyers, investors and sellers should all familiarise themselves with property stamp duties. Understanding the intricacies of these duties can help you navigate the process of property transactions in Singapore with more confidence, optimising your financial outcomes.

If you're still unsure or have any questions, don't hesitate to seek help from the pros. There are lawyers, accountants and experts from PropNex who are ready to assist you in navigating these stamp duties so you can fully understand the obligations involved in property transactions in Singapore.

Related article: Is ABSD Applicable When Inheriting Property?

For more property news and content, click here.

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.