Navigating the Singapore Property Market: A Comprehensive Guide for Foreign Investors (2024)

Singapore's real estate market stands as a beacon of stability and prosperity in Asia and possibly the world. With an excellent infrastructure and multicultural ambience, it's no wonder that people from all over the world are drawn to it.

Foreigners are drawn to Singapore's property market for various reasons. While some come for business opportunities, others are here to raise their children in a safe environment with world-class education. However, the biggest appeal for foreign buyers is the potential for high returns without having to pay taxes for capital gain or inheritance.

However, buying a property on this island can be quite intimidating, especially for foreigners. There is much to consider, so understanding the market landscape and dynamics is crucial.

But don't worry! This guide will help you navigate the exciting possibilities of Singaporean property ownership. Learn more about the market, discover the perks and benefits, and unlock the lifestyle and financial rewards that await you.

Regulations and Eligibility

First and foremost, it is important to know the latest rules and regulations surrounding Singapore's real estate. As of right now, foreigners are only allowed to buy private properties. However, there are limited exceptions to that. Find out below which types of property (which we will further elaborate on later) you can buy as a foreigner.

Getting to know the market

Now that you know which properties you can buy, it's time to familiarise yourself with Singapore's real estate scene.

Types of Properties

As we've mentioned previously, there are various types of properties that you can invest in. We'll cover the comprehensive breakdown of all property development types in a future article. For now, let's focus on the property types that foreigners can buy.

1. New HDB Flats

A Housing and Development Board or HDB flat is public housing subsidised by the Singaporean government. These flats are created to provide affordable housing for Singaporeans, so there are strict eligibility requirements, especially regarding citizenship. That said, non-SPR foreigners cannot buy a new HDB flat, and SPRs can only buy it if they are married or related to an SC.

2. Resale HDB Flats

As the name suggests, a resale HDB flat refers to an HDB property that is being sold in the open market by the current owner. To qualify as a resale flat, the owner must complete the 5-year MOP. Eligibility requirements for resale HDB flats are still pretty strict but they are slightly more lenient. With a valid pass, non-SPR foreigners can jointly purchase a resale HDB flat with their SC spouse or family member. Whereas SPRs can jointly purchase it with an SC or another SPR.

3. New ECs

Also known as 'sandwich flat', an executive condominium is a public-private hybrid housing suitable for middle-income Singaporeans who can't qualify for an HDB flat due to the income ceiling cap, but still consider private condos out of their budget. Even though ECs are built by private developers, they are more affordable than private condos because they are managed and subsidised by the government. Consequently, eligibility requirements for new ECs are also strict. Non-SPR foreigners cannot buy a new EC, but SPRs can jointly purchase one with their SC spouse or family member.

4. Resale ECs

After the 5-year MOP, from the 6th to the 10th year, ECs are sold in the open market as resale. Although non-SPR foreigners still cannot purchase a resale EC, SPRs can buy one on their own.

5. Privatised ECs

One special thing about ECs is that they become fully privatised after 10 years. So, from the 11th year onward, it's considered private housing and will no longer be subject to the same restrictions. This means that anyone, including non-SPR foreigners, can purchase them.

6. Private Condos

A private condominium is a housing development that offers individual units within a larger complex. There are common facilities shared by all unit owners such as gyms, swimming pools, function rooms and BBQ pits. This type of housing comes with little to no restrictions and is more affordable than other types of private properties.

7. Resale Private Condos

A resale private condo is sold in the open market by the current owner. These condos have lower prices compared to new launches, so competition will be stiffer.

8. Strata-landed Housing

A strata-landed development is a mix of bungalows, semi-detached houses and terrace houses at a common development site. This type of housing typically comes with shared communal facilities and a single vehicular access point.

9. Landed Residential Properties

A landed property is a private residential housing attached directly to the land. This means that the ownership pertains to both the land and the property.

Location

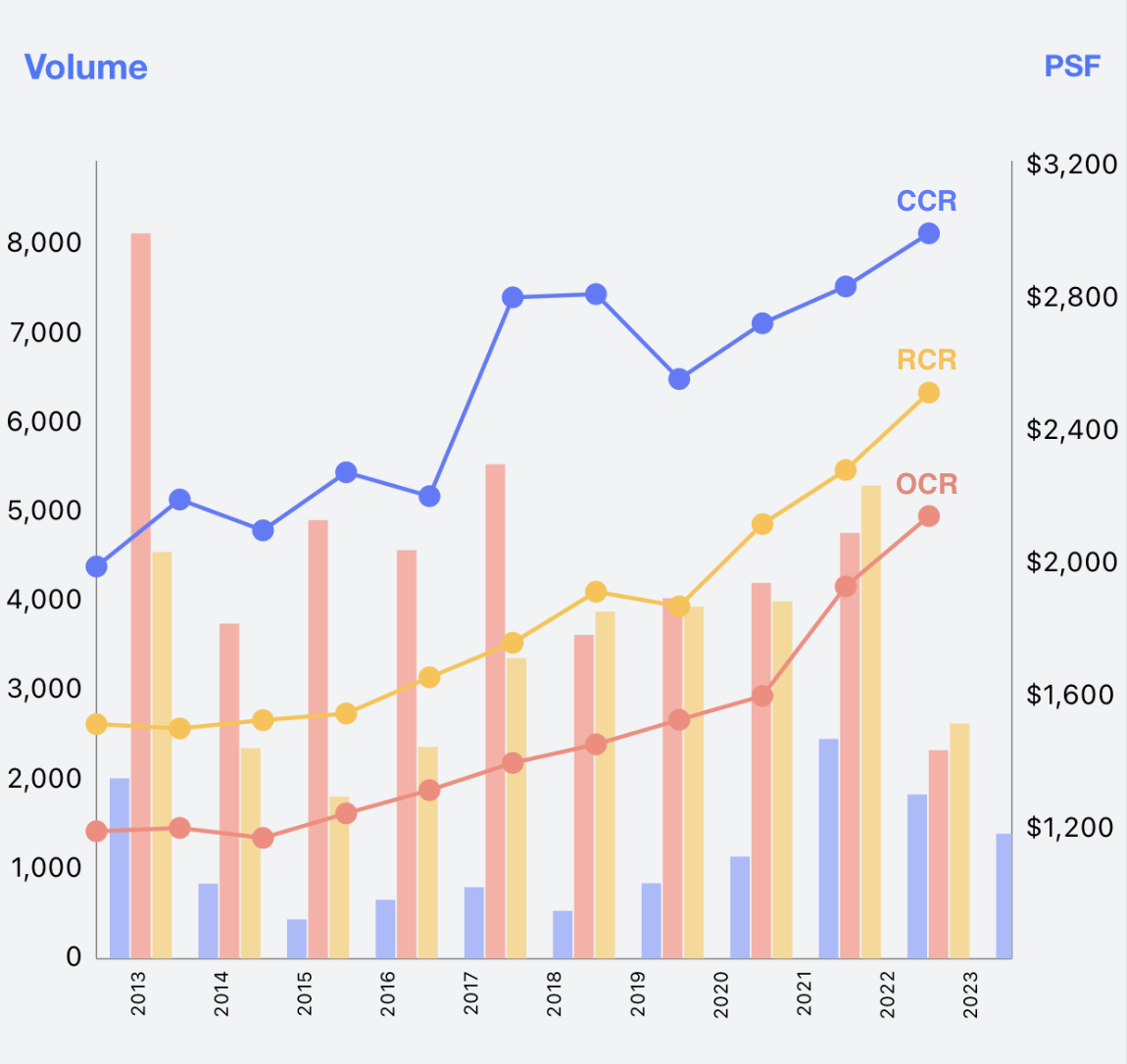

Singapore is divided into three main regions: Core Central Region (CCR), Rest of Central Region (RCR) and Outside Central Region (OCR). Each of them offers its own unique attribute, so it all comes down to your preference and needs for the property.

CCR is the heart of Singapore where most high-end properties and the Central Business District (CBD) are located. It's synonymous with cosmopolitan and luxurious living so unit prices in this region are significantly higher. Over the past 10 years, unit prices in this region have experienced some fluctuations due to anti-speculative measures and market sentiments. However, they have stabilised in recent years.

The RCR, situated in between the CCR and OCR, offers a mid-range pricing option. It is an attractive choice for those who want to stay close to the city centre without the high cost of luxury units in the CCR. Price trends in this region have been pretty consistent throughout the decade and they continue to rise along with ongoing demands for housing.

Further away from the city centre, we have the OCR, which takes up about 75% of the island. Despite its distant location, this region is by no means secluded, as Singapore has great MRT connectivity all around. Properties in this region are much more affordable, yet spacious, so prices are also consistently rising up in the past decade.

For more details, read our article District Diary: Mapping Out Regions in Singapore

Source: PropNex Investment Suite Market Updates Tool

Financial navigation

Before making any purchase, it is important to understand the costs and expenses of owning a property in Singapore. This way, you can prepare yourself and be ready to tackle the financial aspect of being a property owner.

Option to Purchase (OTP)

The first expense that you have to prepare for is the OTP fee. This includes the option fee and option exercise fee. The option fee itself usually costs 1% of the property's purchase price and should be $1,000 at most. Combined with the option exercise fee, the total cost should not exceed $5,000. That being said, the OTP fee can differ depending on the agreed terms between the buyer and seller, though it's typically set at $1,000.

Click here to read more about OTP.

Downpayment

Once you decide to move forward with the purchase, it's time to sort out the down payment. Generally, foreign investors need to pay 25% of the purchase price in cash. However, this might not apply to you if you are an SPR or if you are trying to purchase a public property with a spouse and/or family members who are SCs. As an example, if you are purchasing a property that costs $1,000,000, then as a foreigner, you have to pay $250,000 upfront and in cash. Then you can pay off the remaining 75% in loans, but more on that later.

Legal fees

To help with the legal intricacies of your property transactions, you might have to find a conveyancing lawyer. The expenses for legal help may vary on a case-to-case basis, but the average cost ranges from $2,300 to $3,200. For HDB purchases, you can engage a solicitor to act on your behalf but do note that HDB has their own rates.

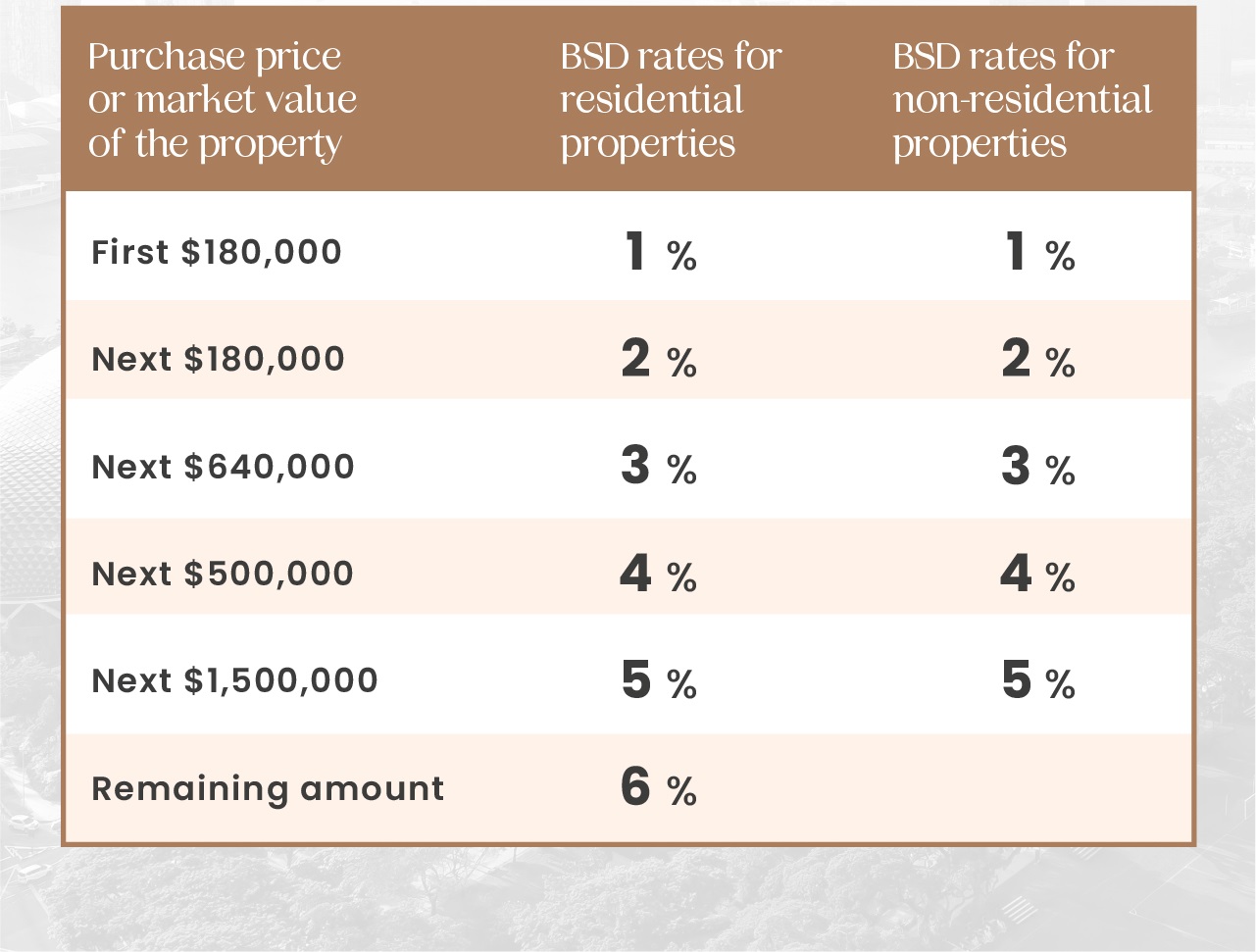

Buyer Stamp Duties (BSD)

BSD is a form of tax that you need to pay when you acquire a property in Singapore. It is computed based on either the purchase price or the market value, whichever is higher. The latest BSD rates (for acquisition of property on or after 15 February 2023) are as follows.

Additional Buyer Stamp Duties (ABSD)

On top of the BSD, an ABSD is also imposed on foreign buyers. The ABSD rates for foreigners are typically higher than SCs. For SPRs, ABSD rates range from 5-35% depending on how many properties you currently own. Whereas for non-SPR, the ABSD rate is 60%. That being said, there are certain cases in which you might be eligible for remissions or exemptions from stamp duties.

Click here to learn more about stamp duties and their remissions.

Other expenses

Even after successfully purchasing your property in Singapore, you still need to consider other ongoing expenses such as maintenance fees, property taxes and insurance. Not to mention unexpected expenses such as repairs and renovations, especially if you plan on renting your property out. So, make sure you have a good budget plan that can cover all these costs.

Loans and mortgages

Fortunately, home loans and mortgages are available to foreigners. However, you'd have to meet certain criteria. Lenders typically look at your income, employment status, credit history and existing debt. Additionally, you need to prepare some documents like proof of income, bank statements, work permit or employment pass.

If you do qualify, you can get up to 75% of financing, meaning you have to make a down payment of at least 25%, as we have mentioned previously. You also need to choose between a fixed interest rate, which will be stable throughout the entire time, or variable interest rate, which will fluctuate depending on market conditions. Each bank offers different packages so make sure to compare and see which one benefits you the most. You should also negotiate with your banker to get a better deal and look out for discounts.

If everything goes well, you will obtain an In-Principle Approval (IPA), which is a confirmation of the maximum amount that your bank is willing to loan you. IPA is usually only valid for three to six months, so you will have to search for a property during this period.

Why should you buy a property in Singapore?

At this point, you might think to yourself Buying property in Singapore seems complicated and costly, especially for foreigners. So, why should I do it? Well, there are plenty of benefits that undoubtedly outweigh any drawbacks. We touched upon some of these earlier in the article, but let's recap, shall we?

First off, expats living in Singapore for work prospects may want the convenience of having their own place. Somewhere they can settle down and start a family, maybe even send their kids to school here. After all, Singapore is a safe country with a great education system and multicultural environment, an ideal place to raise a family.

Secondly, Singapore's real estate market is stable and resilient, making it an attractive option for long-term investment. Its steady political and economic climate also create a secure environment to invest in. Since property values tend to increase over time along with inflation rates, you're going to see profits rolling in before you know it. And here's the kicker: NO capital gain or inheritance tax to worry about, unlike many other countries.

Additionally, there aren't any restrictions on where foreigners can buy property except for public housing and certain freehold landed properties, which you might need permission for.

Finding the right help and resources

Getting around the Singapore property scene can be daunting, especially for foreigners. But don't be afraid to reach out to the experts for a smooth sailing and efficient experience. Connect with Propnex agents to receive top-notch guidance throughout your property purchasing journey, from start to finish.

Final thoughts

In conclusion, Singapore's property market presents promising opportunities for foreign buyers like yourself. With the proper understanding of regulations, market dynamics and proper financial planning, along with professional guidance, you can rest assured that your investment will be fruitful. So, take the leap of chance and begin your journey in successful property ventures in Singapore! Connect with us should you need professional guidance.

Related articles: Property Legal Brief: Tougher for Foreigners to Buy Commercial & Residential Properties. How to Safeguard Your Legacy?, Should Foreign Buyers Be Deterred By The 30% ABSD?

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.