Developers' Sales Plunged By 87% MOM In November Amid Limited New Launches; City Fringe Projects Dominate Sales

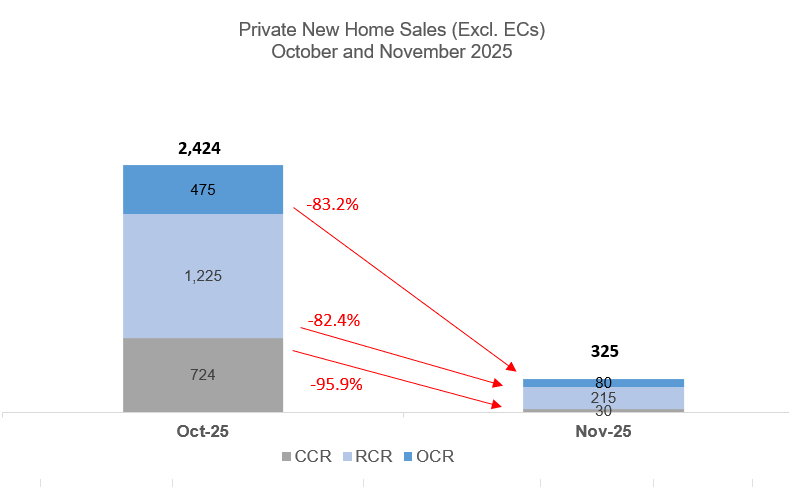

15 December 2025, Singapore - New private home sales fell sharply in November after posting an 11-month high sales volume in October. Developers' sales plunged by 86.6% to 325 units (excluding executive condos) in November - down from the 2,424 units shifted in October - amid fewer new project launches in the month. On a year-on-year basis, developers' sales declined by 87.3% from the 2,560 units transacted in November 2024.

Developers launched 347 new units for sale in November, marking an 84% drop from the 2,233 units that were put on the market in October. There was only one new project launched in November, being the 347-unit The Sen near Beauty World. In contrast, four new launches (Skye @ Holland, Penrith, Faber Residence, and Zyon Grand) offering 2,233 units were placed for sale in October.

The Rest of Central Region (RCR) led developers' sales in November with 215 units sold - down significantly from 1,225 units shifted in the previous month. Several of the top-selling projects in November are in the RCR (see Table 2). The Sen topped the list by selling 77 units at a median price of $2,339 psf, followed by The Continuum and Bloomsbury Residences which each sold 22 units at median prices of $2,567 psf and $2,533 psf, respectively. Zyon Grand and One Marina Gardens also contributed to RCR sales in November.

Over in the Outside Central Region (OCR), developers sold 80 new homes (ex. EC) in the month compared with 475 units transacted in the October. The two joint top-sellers in the OCR in November were Faber Residence and The Lakegarden Residences which each sold 13 units at median prices of $2,162 psf and $2,226 psf, respectively. As at end-November, there were 1,070 unsold non-landed new private homes (ex. EC) from launched projects in the OCR, which means about 90% of the 10,221 units from existing OCR projects (non-landed, ex. EC) have already been sold, according to the URA data. The limited unsold inventory bodes well for OCR new launches in 2026, which is anticipated to account for about 65% of the units (ex. EC) in next year's launch pipeline, based on PropNex's estimates.

Meanwhile, new home sales in the Core Central Region (CCR) slipped to 30 units in November from a high of 724 units in October, where the launch of Skye @ Holland had spurred sales. The projects that led CCR sales in November were River Green and The Robertson Opus which sold four units each at median prices of $3,339 psf and $3,492 psf, respectively. Notably, River Green has sold about 92% of its 524 units since its launch in August 2025 - underscoring healthy buyer interest in that locale and likely bolstering confidence for the adjacent project (the 455-unit River Modern) slated for launch in Q1 2026.

In the EC segment, developers sold 21 new units in November, down marginally from the 22 units sold in the previous month. The best-selling EC project was Otto Place which transacted 16 units at a median price of $1,745 psf in November. EC sales are expected to see a swift pick-up when the 748-unit Coastal Cabana in Pasir Ris hits the market in January 2026. It was reported that Coastal Cabana - the first EC launch in Pasir Ris since 2013 - had attracted more than 4,000 visitors to its sales gallery during its preview weekend (6/7 Dec).

Ms Wong Siew Ying, Head of Research and Content, PropNex said:

"The slump in sales in November was not unexpected, reflecting the quieter launch pipeline in the year-end period. Naturally, developers' sales fall as the number of new launches peter out. On this note, we would expect new home sales in December to remain tepid amid a dearth of launches. The moderation is mainly due to a lack of fresh launches and not a sign of weakening demand; we anticipate new home sales could rebound in January when new projects come on the market.

Some of the upcoming private condo projects (ex. EC) in January may include the 246-unit Newport Residences (freehold mixed-use development in Anson Road) in the city, and the 540-unit Narra Residences in Dairy Farm Walk in the OCR. These projects will be part of a tighter pipeline of new launches in 2026, where some 20 projects (ex. EC) with around 8,400 units may be on tap, based on PropNex's estimates. This is less than the 25 projects (ex. EC) which offered a total of 11,500 units that were launched in 2025. We reckon the tighter launch supply may have a potential to influence buyer behaviour, perhaps reducing the 'wait-and-see' attitude among prospective buyers while home-hunting.

In November, 57.1% of the non-landed new private homes (ex. EC) sold were priced at below $2.5 million, down slightly from the 59.6% proportion in October. That more than half of the developers' sales in November were transacted at below $2.5 million even though the RCR - seen as a mid-tier segment - dominated market activity suggests that developers are pricing units competitively to stay within the affordability range of buyers and HDB upgraders.

Table 1: Proportion of non-landed new private home sales by nationality by residential status by month (ex. EC)

Nationality by Residential Status | Jan-25 | Feb-25 | Mar-25 | Apr-25 | May-25 | Jun-25 | Jul-25 | Aug-25 | Sep-25 | Oct-25 | Nov-25 |

Foreigner (NPR) | 1.0% | 0.6% | 1.1% | 2.5% | 2.5% | 1.1% | 1.8% | 1.1% | 6.1% | 1.3% | 2.8% |

Singapore Permanent Residents (PR) | 8.2% | 6.1% | 9.0% | 11.6% | 14.0% | 12.2% | 11.7% | 7.6% | 9.8% | 11.6% | 13.0% |

Singaporean | 90.8% | 93.3% | 89.7% | 85.9% | 83.5% | 86.7% | 86.5% | 91.3% | 84.1% | 87.1% | 84.3% |

Total | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100 % | 100% | 100% | 100% |

Singaporean buyers accounted for the vast majority of non-landed new home sales (ex. EC) in November at 84% of the transactions (see Table 1), followed by Singapore PRs at 13%. Meanwhile, foreigners (non-PR) made up 2.8% of the sales in November, reflecting nine deals in absolute terms. They comprise two units at One Marina Gardens, and one each in Canninghill Piers, LyndenWoods, Midtown Bay, The Arcady at Boon Keng, The Continuum, The Sen, and W Residences Marina View - Singapore.

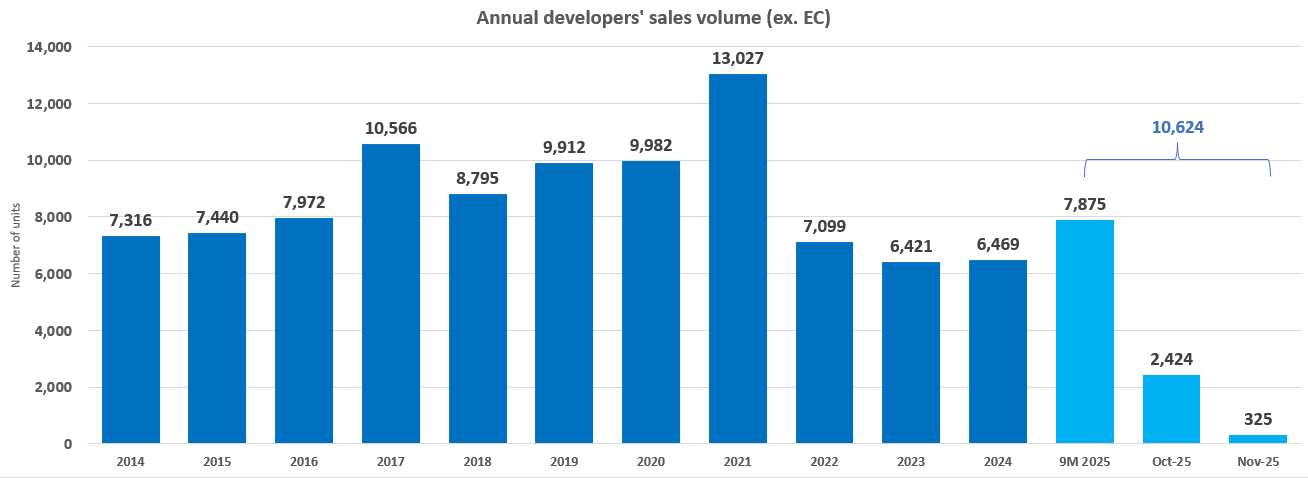

All in, developers have shifted 10,624 units (ex. EC) in the first 11 months of 2025 - only the third time that yearly new home sales have breached the 10,000-unit level since 2014 (see Chart 1). It is a relatively rare milestone and it underscores just how resilient the demand has been this year, supported by a confluence of favourable factors such as easing interest rates, competitive pricing, and a slate of well-located launches. Moving ahead, PropNex expects developers' sales may come it at around 8,000 to 9,000 units (ex. EC) in 2026, owing to the fewer units that could be launched next year."

Chart 1: Annual new private home sales (ex. EC)

Table 2: Top-Selling Private Residential Projects (ex. EC) in November 2025

S/N | Project | Region | Units sold in Nov 2025 | Median price in Nov 2025 ($PSF) |

1 | THE SEN | RCR | 77 | $2,339 |

2 | THE CONTINUUM | RCR | 22 | $2,567 |

3 | BLOOMSBURY RESIDENCES | RCR | 22 | $2,533 |

4 | ZYON GRAND | RCR | 19 | $3,211 |

5 | ONE MARINA GARDENS | RCR | 18 | $3,019 |

6 | FABER RESIDENCE | OCR | 13 | $2,162 |

7 | THE LAKEGARDEN RESIDENCES | OCR | 13 | $2,226 |

8 | GRAND DUNMAN | RCR | 10 | $2,538 |

9 | CANBERRA CRESCENT RESIDENCES | OCR | 9 | $2,005 |

10 | PENRITH | RCR | 8 | $2,803 |

Suggested Reads

Upcoming Events

View moreYou may like

Growth In Private Home And HDB Resale Flat Prices Touched Multi-Year Low In 2025, While Housing Demand Stayed Resilient, Settling Into A Goldilocks Market

January 23, 2026

Propnex's Singapore Budget 2026 Wish List: Targeted Policy Recalibration To Further Promote Market Stability, Improve Affordability, And to Encourage Urban Renewal

January 06, 2026

Brisk Home Sales Helped To Support Private Home Prices In Q4 2025, While HDB Resale Prices Were Flat On Weaker Resale Volume

January 02, 2026