Q3 2024 Flash Data: Private Home Prices Fell On Weaker Sales, HDB Resale Flat Prices Gained Strength

01 October 2024, Singapore - Flash estimates showed diverging price trends between private residential properties and public housing resale flats in Q3 2024. Overall private home prices fell for the first time since Q2 2023, while the growth momentum in HDB resale prices continued to gain traction in Q3 2024, backed by healthy demand for resale flats.

Q3 2024 URA Private Residential Property Index (Flash)

Flash estimates from the URA showed that overall private home prices fell by 1.1% QOQ in Q3 2024, compared with the 0.9% QOQ increase in Q2 2024 - marking the first quarterly decline since Q2 2023 where prices dipped by 0.2% QOQ (see Table 1). Cumulatively, overall private home prices rose by 1.1% in the first nine months of 2024, compared with the 3.9% increase in the same period in 2023. The flash estimates capture transactions up till mid-September, and the final print will be published on 25 October.

Table 1: URA Private Property Price Index (PPI)

Price Indices | Q1 2023 | Q2 2023 | Q3 2023 | Q4 2023 | 2023 | Q1 2024 | Q2 2024 | Q3 2024 (Flash) |

(QOQ % Change) | (YOY % Change) | (QOQ % Change) | ||||||

Overall PPI | 3.3 | -0.2 | 0.8 | 2.8 | 6.8 | 1.4 | 0.9 | -1.1 |

Landed | 5.9 | 1.1 | -3.6 | 4.6 | 8.0 | 2.6 | 1.9 | -3.8 |

Non-Landed | 2.6 | -0.6 | 2.2 | 2.3 | 6.6 | 1.0 | 0.6 | -0.3 |

| 0.8 | -0.1 | -2.7 | 3.9 | 1.9 | 3.4 | -0.3 | -1.5 |

| 4.4 | -2.5 | 2.1 | -0.8 | 3.1 | 0.3 | 1.6 | 0.2 |

| 1.9 | 1.2 | 5.5 | 4.5 | 13.7 | 0.2 | 0.2 | -0.1 |

The landed private homes segment had put a drag on overall prices, posting a 3.8% QOQ decline in Q3 2024, following the 1.9% QOQ increase in the previous quarter. The price decline came amidst lower transactions across all landed housing types (detached, semi-detached, and terrace house); overall private landed home sales fell by 20% QOQ in Q3 2024, based on URA Realis caveat data.

Meanwhile, private non-landed homes witnessed a marginal price decline of 0.3% QOQ in Q3 2024 after four straight quarters of price growth. In the first nine months of 2024, non-landed private home prices have climbed by a cumulative 1.3%, much slower than the 4.2% increase for the corresponding period in 2023. Within the non-landed homes segment, prices in the Core Central Region (CCR) fell by 1.5% QOQ in Q3 2024, while the Outside Central Region (OCR) saw a 0.1% QOQ dip in prices. The Rest of Central Region (RCR) bucked the down-trend, posting a slender 0.2% QOQ price growth in Q3 2024.

PropNex anticipates that the final PPI print for non-landed homes and the RCR could improve slightly, when the transactions at new launch 8@BT in Beauty World are taken into consideration. The project was put on the market on 21 September and it shifted 53% of its 158 units at an average price of $2,719 psf.

Based on URA data and caveats lodged, developers sold an estimated 1,072 new private homes (ex. EC) in Q3 2024 (till 22 Sep), taking the total to around 2,960 units in the first nine months of 2024. Meanwhile, URA Realis caveat data showed that there were 3,068 private residential resale transactions (ex. EC) in Q3 2024, bringing the nine-month figure to an estimated 9,559 units.

For the whole of 2024, PropNex projects that new home sales (ex. EC) may come in at around 4,500 to 5,000 units, and private resale transactions may hover at around 12,000 to 13,000 units. Meanwhile, overall private home prices could grow by 2.5% to 3.0% in 2024 - slowing from the 6.8% growth in 2023.

Mr Ismail Gafoor, CEO of PropNex Realty said:

"The slight price decline in Q3 2024 may be attributed to several factors, such as the weaker transaction volumes, limited number of major new launches during the quarter, and developers pricing units sensitively in a market where buyers have more choices, and are generally not in a rush to commit to a property purchase. We anticipate that the URA PPI may improve marginally when the final print is out, capturing sales from the rest of September.

In recent years, private home prices in Singapore have been relatively resilient, holding up against the weight of some of the highest interest rates we have witnessed in decades, fresh rounds of cooling measures, and slower sales. We think a slight moderation or gradual movement in price trends, coupled with optimism around the potential easing in home loan rates and positive economic outlook will be welcomed by homebuyers.

With more project launches coming up in Q4 2024, we think private home prices could find some support, as new home sales tend to boost overall prices. In Q3 2024, there were three fresh projects being launched, namely Sora in Yuan Ching Road and the freehold Kassia in Flora Drive, as well as 8@BT in the RCR - which were the best-selling projects in Q3 2024 (see Table 2).

Table 2: Popular private residential projects and top deals in Q3 2024*

Top 5 new sales in Q3 2024 by projects | Top 5 resales in Q3 2024 by projects | ||||

Project name | Region | Transactions | Project name | Region | Transactions |

KASSIA | OCR | 162 | TREASURE AT TAMPINES | OCR | 46 |

SORA | OCR | 110 | JADESCAPE | RCR | 28 |

8@BT | RCR | 83 | PARC ESTA | RCR | 25 |

TEMBUSU GRAND | RCR | 71 | THE TAPESTRY | OCR | 24 |

HILLHAVEN | OCR | 68 | CUSCADEN RESERVE | CCR | 21 |

| Priciest landed and non-landed private home transactions in Q3 2024 | |||||

Project name/ address | Region | Sale price | Property type | Tenure | Sale date |

1X CLUNY HILL | CCR | $52 million | Detached house | Freehold | Jul-24 |

32 GILSTEAD | CCR | $14.71 million | Apartment | Freehold | Aug-24 |

While the new home sales market got off to a slow start this year, there is some optimism that things could end on a more upbeat note, on account of several launches coming up, and possibly an improvement in sentiment following the bumper rate cut by the US Federal Reserve in September. In Q4 2024, the projects that are expected to hit the market are the 226-unit Meyer Blue, 552-unit Nava Grove, 348-unit Norwood Grand, and 504-unit Novo Place EC in Tengah. Meanwhile, there is also a chance that the 916-unit Chuan Park may potentially come on before the year is out.

In the near-term, we expect prices of new launches to stay fairly resilient owing to the high land acquisition cost, rising construction costs, as well as elevated financing cost borne by property developers. Meanwhile, sites that are affected by the new rules on harmonisation of gross floor area definitions will also see higher PSF pricing due to the reduction in the saleable area in the development.

We note that foreigners' participation in private home sales remained low. In Q3 2024 (till 22 September), foreigners (non-PR) made up 1.3% of the total non-landed private new and resale transactions (ex. EC), compared with 2% in the previous quarter. Foreign investment demand has waned since the additional buyer's stamp duty measure was tightened in April 2023. For comparison, the proportion of non-landed private new sale and resale transactions to foreigners (non-PR) was 4.2% in Q2 2023 and 7.2% in Q1 2023, according to URA Realis caveat data. Singaporean buyers accounted for 81.3% of the sales while Singapore PRs constituted 17.2% of the non-landed private homes transactions in the quarter, according to caveats lodged."

Q3 2024 HDB Resale Price Index (Flash)

Flash estimates released by the Housing and Development Board (HDB) showed that prices of resale flats climbed at a faster pace yet again, rising by 2.5% QOQ in Q3 2024, following the 2.3% QOQ growth in Q2 and the 1.8% QOQ increase in Q1 (see Table 3). Taking in the latest data, the HDB resale price index has risen by a cumulative 6.8% in the first nine months of 2024. For the full year 2024, PropNex expects HDB resale prices to climb by 8% to 9% - outpacing the 4.9% price growth in 2023.

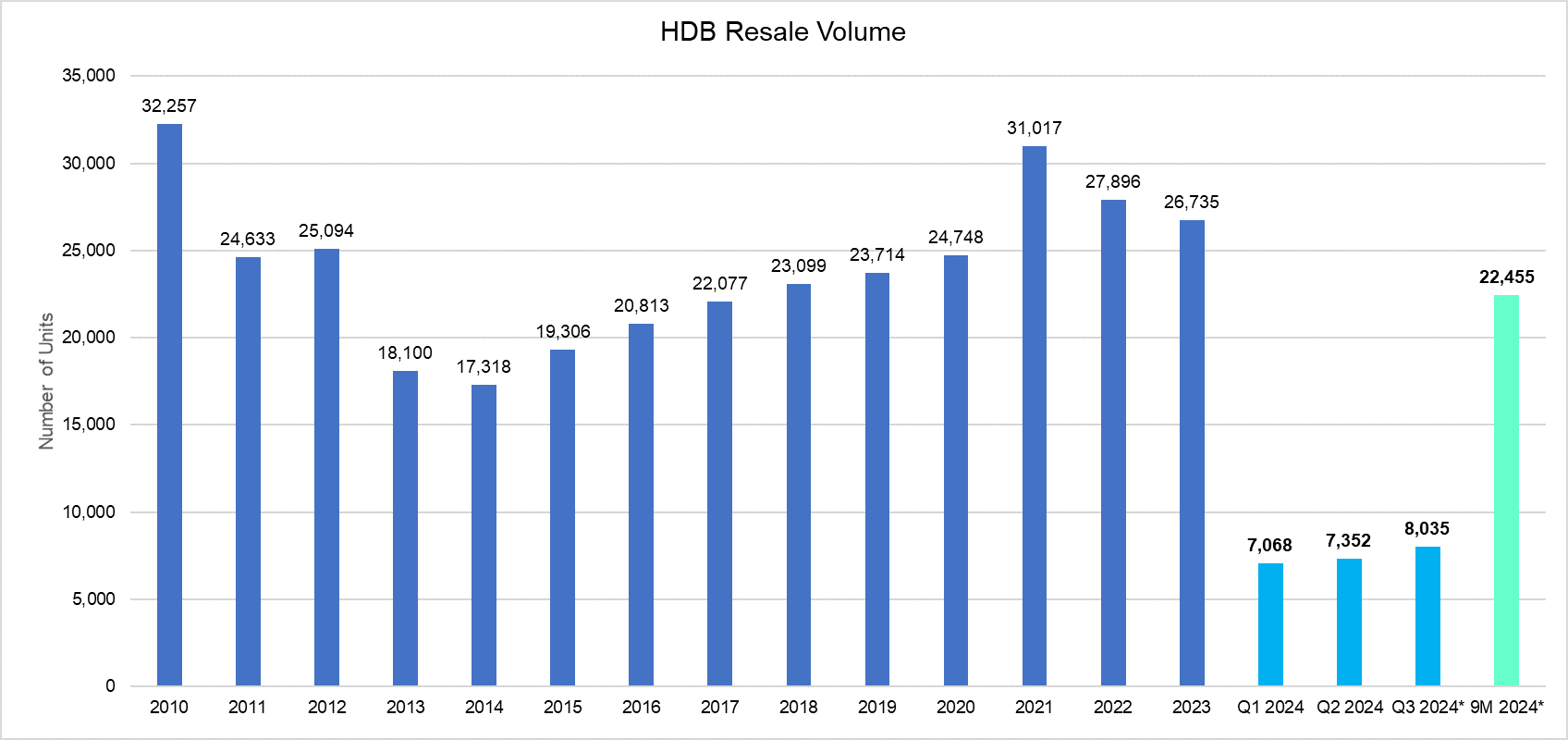

The price growth can be attributed to the healthy demand for HDB resale flats, which have seen higher transactions in recent quarters. The HDB said that 8,035 flats have been resold in Q3 2024 (till 29 Sep 2024). This has surpassed the 7,068 units resold in Q1 2024, and 7,352 units transacted in Q2 2024 (see Chart 2) - marking what would be the strongest resale volume since Q3 2021 where 8,433 flats were resold. In the first nine months of 2024, HDB resale volume has reached 22,455 units.

PropNex expects the HDB resale volume could potentially come in at 28,500 to 29,500 units for the whole of 2024, outperforming the 26,735 flats resold in 2023.

Table 3: HDB Resale Price Index

Quarter | QOQ % change | YOY % change |

Q1 2021 | 3.0% | 8.1% |

Q2 2021 | 3.0% | 11.0% |

Q3 2021 | 2.9% | 12.5% |

Q4 2021 | 3.4% | 12.7% |

Q1 2022 | 2.4% | 12.2% |

Q2 2022 | 2.8% | 12.0% |

Q3 2022 | 2.6% | 11.6% |

Q4 2022 | 2.3% | 10.4% |

Q1 2023 | 1.0% | 8.8% |

Q2 2023 | 1.5% | 7.5% |

Q3 2023 | 1.3% | 6.2% |

Q4 2023 | 1.1% | 4.9% |

Q1 2024 | 1.8% | 5.8% |

Q2 2024 | 2.3% | 6.6% |

Q3 2024 (Flash) | 2.5% | 7.9% |

Chart 1: HDB resale flat volume by year

During the quarter, the government rolled out further cooling measures - a 5 percentage-point reduction in the loan-to-value (LTV) limit for HDB loans to 75% - to tame rising resale flat prices. The measure which took effect from 20 August is not expected to affect the vast majority of resale flat buyers.

Ms Wong Siew Ying, Head of Research and Content, PropNex Realty said:

"The third quarter of 2024 is shaping up as the strongest quarter of sales for the HDB resale market in about three years, and we expect the HDB resale volume in 2024 may potentially outperformed that of 2022 and 2023, underpinned by healthy demand for resale flats.

In tandem with the higher resale flat volume in Q3 2024, resale flat prices also got a lift, and the HDB resale price index has touched another new high, as per the flash estimates. The price growth in Q3 2024 represents the 18th straight quarter of increase in the HDB resale price index. Cumulatively, HDB resale prices have risen by 6.8% in the first nine months of 2024, faster than the 3.8% price growth in the same period in 2023.

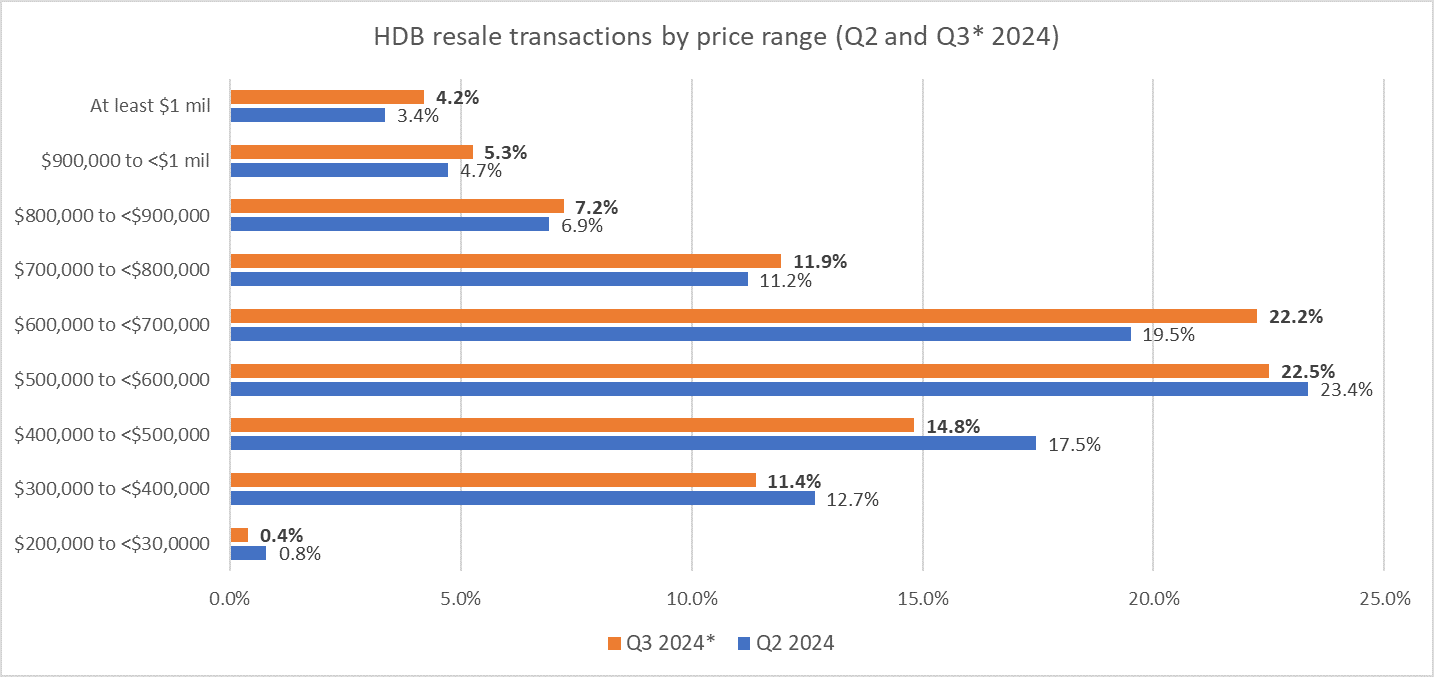

Based on our analysis of the sales data (retrieved on 1 October), the number of flats that have been resold for at least $1 million accounted for about 4% of the transactions in Q3 2024, while the proportion of flats that were sold at price bands of $600,000 or higher has ticked up slightly in Q3 from Q2 2024 (see Chart 2).

Chart 2: Proportion of HDB resale transactions by price range (Q2 and Q3 2024*)

The number of million-dollar resale flats that changed hands hit another record high in Q3 2024, with 331 units sold in the quarter. Including the 419 units of million-dollar flats resold in 1H 2024, there are now 750 such flats transacted in roughly the first nine months of 2024 - already far exceeding the 469 units that were resold in the whole of 2023.

The 331 units of million-dollar resale flats comprised two 3-room terrace flats, 126 units of 4-room flats, 115 units of 5-room flats, and 88 units of executive flats. With the exception of 3-room flats, the numbers of such flats sold for the other flat types in Q3 are all new quarterly highs. Kallang Whampoa led the sales of million-dollar resale flats with 55 transactions in Q3 2024, followed by 45 units in Bukit Merah and 37 units in Queenstown - being the top three estates for such transactions in the quarter.

In September, the number of million-dollar resale flats transacted remained elevated at 106 units, higher than the 105 units in August but easing from a high of 120 units in July. We remain watchful of the possible impact of the August 2024 cooling measures on the HDB resale segment. The LTV limit reduction for HDB loans to 75% is anticipated to potentially curb demand at the top end of the HDB resale market.

That being said, it is possible that many of the buyers of pricier flats are high income households who do not tap HDB loans, or perhaps some of them may have cash proceeds from the sale of a previous private home to finance the resale flat purchase, and hence may not necessarily be affected by the tighter LTV limit for HDB loans.

Looking at Q4 2024, the anticipation of HDB's upcoming build-to-order (BTO) sales exercise in October - where about 8,500 new flats will be offered - may influenced resale flat demand, as some households could be keen to apply for BTO flats in attractive locations. The upcoming BTO flats in 15 projects will be offered under the new flat classification framework - Standard, Plus, or Prime flats - based on their specific locational attributes. They include a number of projects in compelling locations such as the new Bayshore housing estate, in North Bridge Road/Crawford Street not far from the Sports Hub, in Kembangan, as well as two projects near Pasir Ris Central.

However, we expect households who prefer move-in ready homes, as well as those who wish to purchase a flat in choice locations but are not willing to be subjected to the stricter resale and rental conditions, the subsidy clawback upon resale, and a longer 10-year minimum occupation period for Prime and Plus flats, to continue to look to the resale flat market for options."

Suggested Reads

Upcoming Events

View moreYou may like

PropNex Partners Mandai Wildlife Group as Naming Sponsor of 'PropNex Sky Amphitheatre' at Bird Paradise

March 10, 2026

January's New Private Home Sales Signal Steady Start to 2026; Demand for New Executive Condominiums Holds Up

February 16, 2026

Growth In Private Home And HDB Resale Flat Prices Touched Multi-Year Low In 2025, While Housing Demand Stayed Resilient, Settling Into A Goldilocks Market

January 23, 2026