HDB Resale Volume Rebounds As Prices Moderate

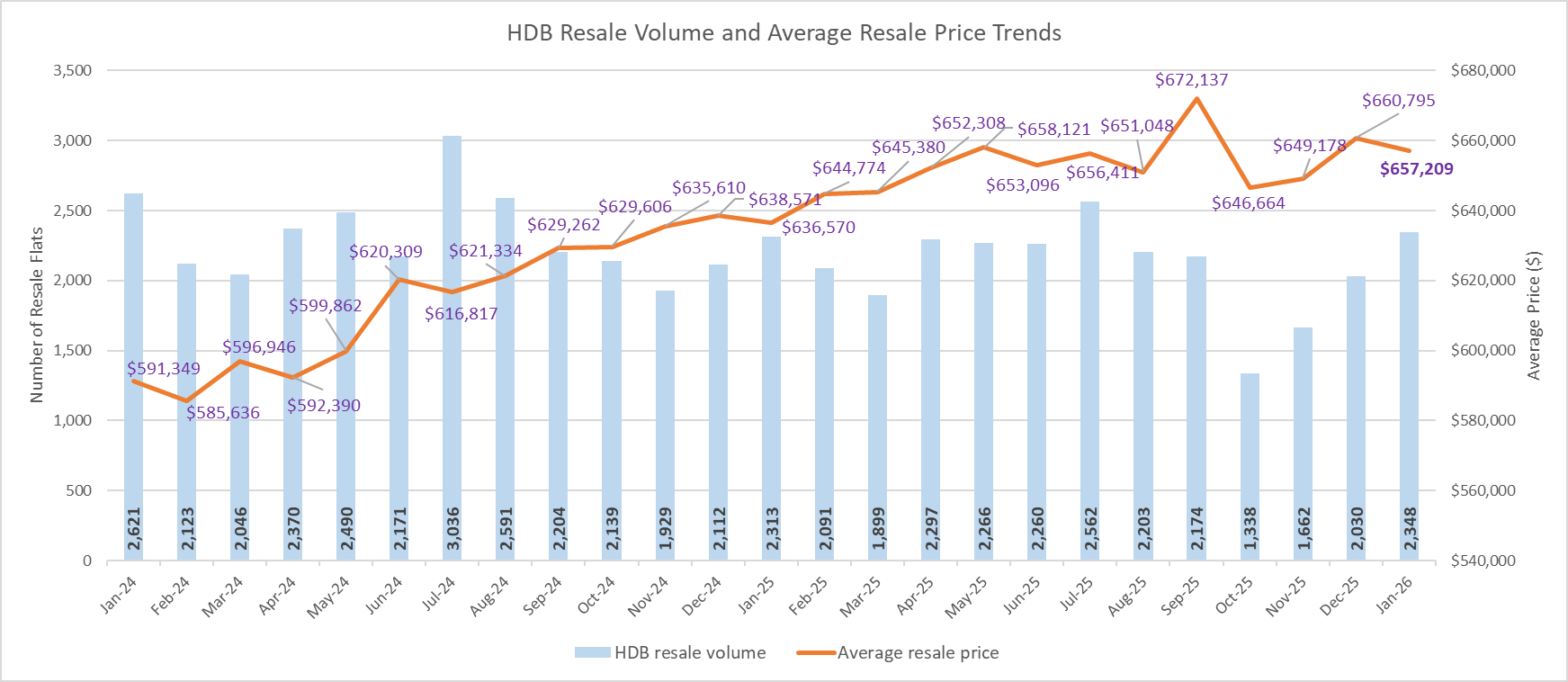

The HDB resale volume rebounded in January 2026, marking three consecutive months of rising sales - suggesting that recent declines in transactions may have bottomed and that market activity is gradually stabilising.

Based on sales data, there were 2,348 resale flat transactions in January, up by 15.7% month-on-month (MOM) from 2,030 units resold in December (see Chart 1). The improvement in sales in recent months following three straight months of decline from August to October 2025 may possibly indicate that that buyers and sellers have recalibrated expectations, and a more balanced demand-supply dynamic is perhaps emerging. On a year-on-year basis, sales were down by 1.5% from the 2,313 resale flats transacted in January 2025. By town, Woodlands, Sengkang, and Tampines led sales in January - accounting for just under a quarter of the month's sales.

Chart 1: HDB resale volume and average resale price

Despite demand returning, the average HDB resale price eased by 0.5% to $657,209 in January from $660,795 in the previous month (see Chart 1). This shows that many buyers are likely selective and price-conscious. Overall, HDB resale prices grew at a slower pace in 2025, as the ramp up in the supply of new flats and existing cooling measures weighed on the market. According to the HDB, resale flat prices rose by 2.9% in 2025 - the slowest annual price growth in six years, since 2019 where prices inched up by 0.1%.

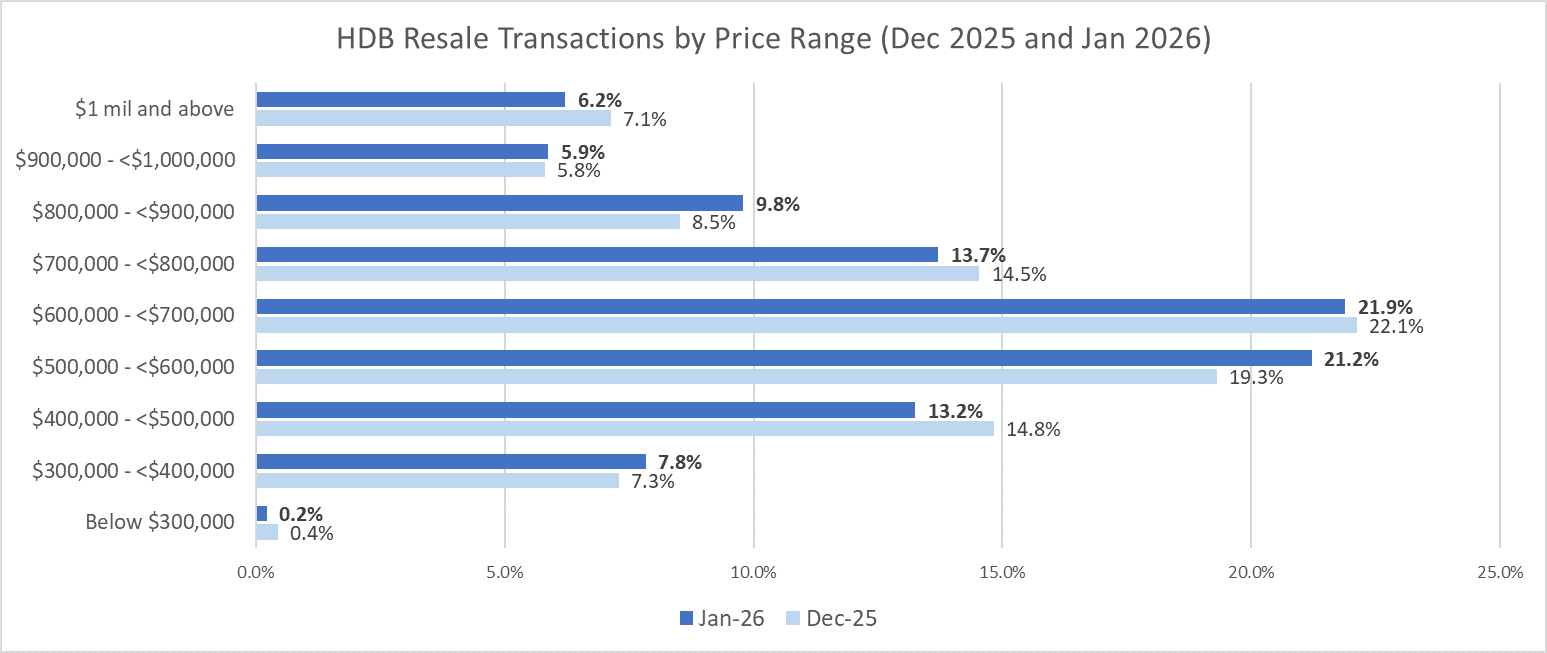

Transaction data showed that the proportion of flats resold that were priced at below $500,000 in January was 21.3% - lower than 22.6% in the previous month. About 43.1% of the resale flats sold fetched between $500,000 and under $700,000, a touch higher than 41.4% in December. Meanwhile, the proportion of deals done at $700,000 to just under $1 million in January inched up to 29.4% from 28.9% in the previous month. Notably, 6.2% of the flats were resold for at least $1 million in January, down from 7.1% a month ago (see Chart 2).

Chart 2: HDB resale flat transactions by price range

By flat type and town classification, the 4-room flats resold in mature towns posted the steepest month-on-month average price growth of 3.0% to about $787,074 in January (see Table 1). This is followed by 3-room resale flats which garnered a 2.6% MOM average price growth to $488,258. It is noted that the average resale prices of 5-room and executive flats in mature towns both witnessed declines in January, suggesting possible price resistance setting in. Over in the non-mature towns, the average resale price of 3-room flats rose the most, by 1.8% MOM, while executive flats saw the sharpest decline at 3.2% MOM.

Table 1: Average HDB resale flat prices by flat type, by town classification

| Mature towns | Non-mature towns | ||||

| Dec-25 | Jan-25 | % change MOM | Dec-25 | Jan-25 | % change MOM |

3 ROOM | $475,734 | $488,258 | 2.6% | $453,114 | $461,455 | 1.8% |

4 ROOM | $764,370 | $787,074 | 3.0% | $608,856 | $605,770 | -0.5% |

5 ROOM | $933,051 | $898,069 | -3.7% | $710,579 | $718,071 | 1.1% |

EXECUTIVE | $1,041,404 | $1,016,401 | -2.4% | $888,904 | $860,366 | -3.2% |

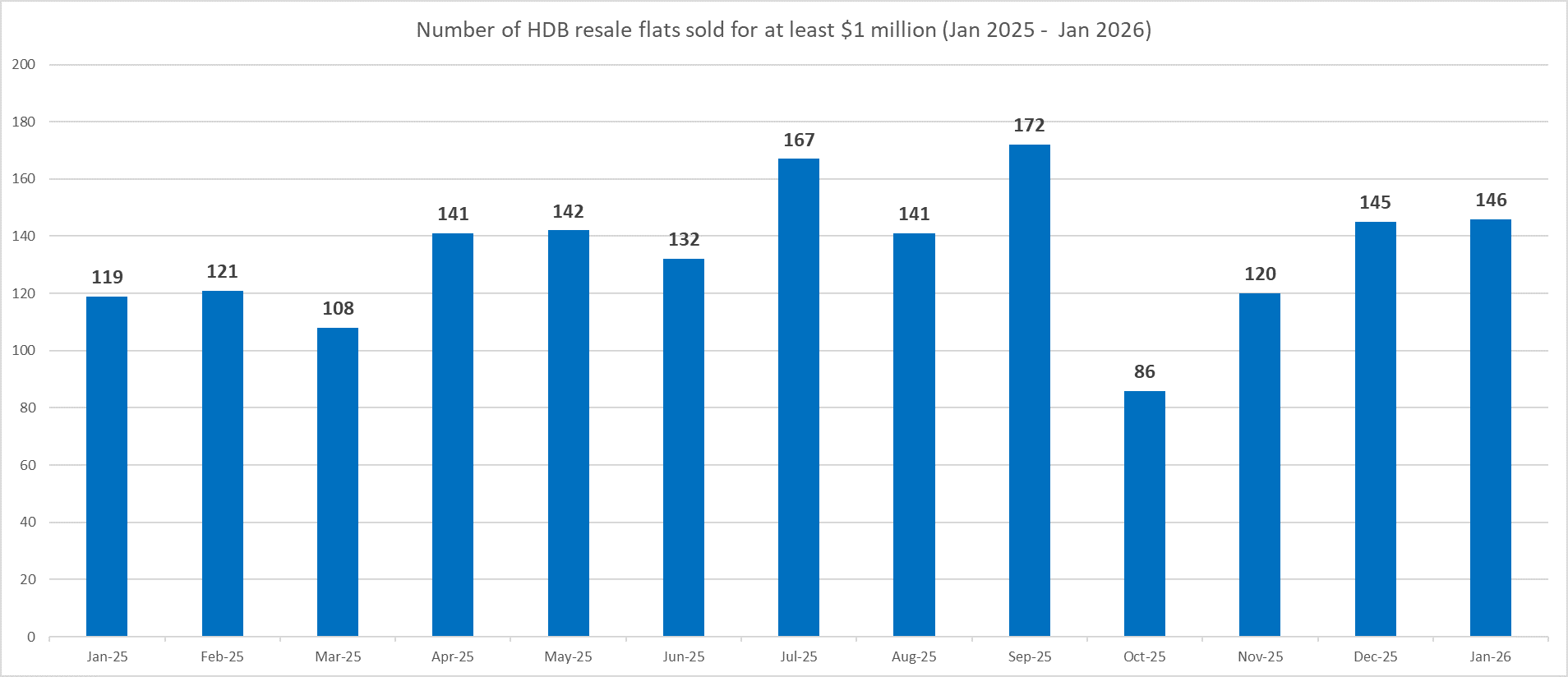

Meanwhile, the number of flats resold for at least $1 million, commonly referred to as million-dollar resale flats, remains elevated. There were 146 such units transacted in January, up marginally from the 145 flats that changed hands in the previous month (see Chart 3). The 146 units of million-dollar resale flats in January comprised 77 units of four-room flats, 35 units of five-room flats, 33 executive flats, and a multi-generation flat.

Among the million-dollar resale flat deals in the month, 13 units are located in non-mature towns - four units in Woodlands, three in Jurong East, two each in Bukit Batok and Hougang, and one each in Punggol and Sengkang. The remaining units are in mature towns, led by Queenstown with 23 units, followed by Toa Payoh and Bukit Merah with 20 and 17 units, respectively.

With a record 1,594 units of million-dollar resale flats transacted in 2025, the firm pace of such sales in January suggests that segmentation within the HDB resale market remains pronounced, and PropNex expects the number of such transactions to remain high in 2026 - likely crossing 1,000 units again.

Chart 3: Number of HDB flats resold for at least $1 million by month

Sales data showed that 16 units of the million-dollar resale flats sold in January had a remaining lease balance of 94 years or more at the point of sale - possibly indicating that they have recently exited their respective 5-year minimum occupation period (MOP). These are located in Ang Mo Kio Street 23 (Ang Mo Kio Court), Clementi Avenue 3 (Clementi Crest), Biddadri Park Drive (Alkaff Courtview), and Alkaff Crescent (Alkaff Lakeview).

In January, the priciest HDB resale flat transacted was a 5-room unit at Pinnacle @ Duxton in Cantonment Road which fetched $1.56 million (see Table 2). The unit which spans 106 sqm is located on a floor ranging between the 19th and 21st storey. It has a lease balance of about 84 years at the point of resale.

Table 2: Top 10 HDB resale flats sold in January 2026 by Transacted Price

Town | Type | Street | Storey range | Floor area (SQ M) | Lease start date | Resale price | PSF ($) |

CENTRAL AREA | 5 ROOM | CANTONMENT RD | 19 TO 21 | 106 | 2011 | $1,560,000 | $1,367 |

BISHAN | 5 ROOM | BISHAN ST 24 | 22 TO 24 | 120 | 2011 | $1,557,000 | $1,205 |

BUKIT MERAH | 5 ROOM | HENDERSON RD | 34 TO 36 | 113 | 2019 | $1,530,000 | $1,258 |

CLEMENTI | 5 ROOM | CLEMENTI AVE 3 | 40 TO 42 | 113 | 2021 | $1,510,000 | $1,241 |

CENTRAL AREA | 4 ROOM | CANTONMENT RD | 37 TO 39 | 95 | 2011 | $1,500,000 | $1,467 |

KALLANG/WHAMPOA | 5 ROOM | BOON KENG RD | 10 TO 12 | 119 | 2011 | $1,480,000 | $1,155 |

CLEMENTI | 5 ROOM | CLEMENTI AVE 3 | 34 TO 36 | 113 | 2021 | $1,470,000 | $1,209 |

QUEENSTOWN | 5 ROOM | DAWSON RD | 37 TO 39 | 107 | 2020 | $1,470,000 | $1,276 |

CENTRAL AREA | 4 ROOM | CANTONMENT RD | 31 TO 33 | 96 | 2011 | $1,435,888 | $1,390 |

BUKIT MERAH | 5 ROOM | HENDERSON RD | 07 TO 09 | 113 | 2019 | $1,428,000 | $1,174 |

In 2026, PropNex expects the HDB resale segment could see further stabilisation with modest price growth, as the injection of new build-to-order (BTO) flats and existing policy guardrails keep the market in check.

Contact a PropNex salesperson to find out more about resale HDB market trends.